The Research Report on ESG Disclosure in Shanghai Financial Industry released

2024-12-31未知责任编辑0

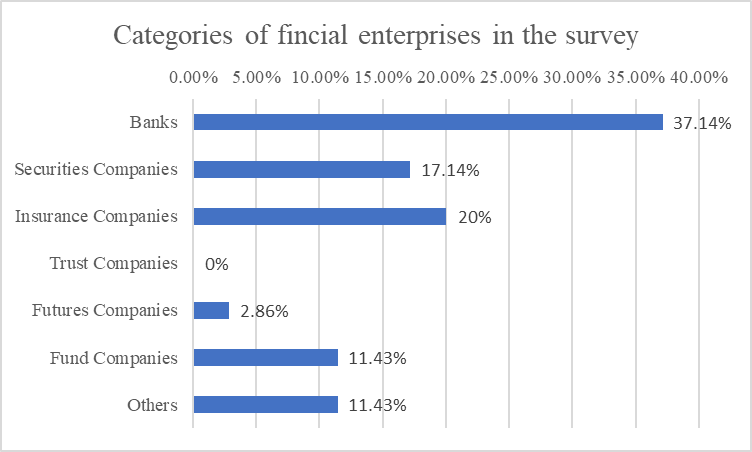

On November 28, 2024, the closing ceremony of the 18th Shanghai Financial Services Fair and the 2nd Sci-tech Innovation Finance Conference co-hosted by Shanghai Financial Association and Lujiazui Financial City were held in Shanghai, during which the Research Report on ESG Disclosure in Shanghai Financial Industry(2024) (Hereinafter referred to as “the Report”) was unveiled.

The Report is the first research report about ESG disclosure in Shanghai financial sector jointly released by Shanghai Financial Association and GoldenBee Consulting.

The Report, through abundant research, analysis and reviews, systematically presents how much Shanghai financial enterprises know about ESG and the status quo of ESG disclosure exploration and development. It summarizes and reviews on the characteristics at this stage of ESG disclosure by listed financial enterprises in Shanghai, and puts forward relevant suggestions to provide references for financial institutions to act on and develop ESG.

Ⅰ. Two major finding on ESG development of financial enterprises in Shanghai

(1) ESG philosophy widely recognized and stressed by Shanghai financial enterprises

Shanghai financial enterprises have been fully aware of the importance of ESG and has rolled out relevant work at different levels.

62.86% of the enterprises state that their leaders have listed ESG among their priorities and have been proactively urging different departments to participate and endeavor in this regard. 5.71% of the enterprises have everyone highly involved in and deeply implement ESG strategies. In addition, 22.86% of them have ESG departments that are initially exploring ESG-related work. A small number of the enterprise only have a brief understanding of ESG but have not yet carried out actions (5.71%). 2.86% of the enterprises have little knowledge about ESG and have not paid attention to it.

(2) The quality of ESG reports of listed financial companies in Shanghai is above the average of Shanghai and China

Analyzed from the six dimensions of integrity, reliability, readability, comparability, creativity, innovation, substance, the reports released by listed companies in Shanghai are outstanding in terms of innovation, readability and integrity, with scores of 88.10%, 82.86% and 80.13% respectively. The scores for reliability and comparability stood at 62.24% and 60.71% and the substance is scored 51.23%, relatively low. However, the listed financial companies in Shanghai outperform the average of Shanghai enterprises and Chinese enterprises in all of the six dimensions, taking a lead in different aspects.

Ⅱ. The ESG development of financial enterprises in Shanghai shows three major characteristics at this stage

(1) The governance of the enterprises shows great momentum but strategic planning needs to be accelerated

Specifically, the disclosure rates of the social responsibility management structure and the participation, guidance or supervision of the board of directors or top executive teams in the social responsibility management are relatively high, accounting for 92.86% and 85.71% respectively. This indicates that these enterprises have realized the importance of fulfilling ESG or social responsibility, have strengthened the top-level design, and have set up a sound and comprehensive ESG and social responsibility management structure and that the senior executives have attached great importance to and have got involved in relevant supervision and management.

The disclosure rates of the integration of social responsibility into the decision-making process of businesses and the visions and strategies of social responsibility are relatively low, constituting 64.29% and 50% respectively and showing much room for improvement.

(2) Environmental development takes initial form but lacks capital investment

In terms of environmental management, Shanghai financial listed enterprises have the highest disclosure rate in establishing an environmental management system, which represents 71.43%, while the disclosure rates of investment in environmental protection and contribution to the industry's experience in improving environmental management are relatively low, accounting for only 7.14% and 14.29%.

Enterprises should establish special funds for energy conservation and environmental protection, making great efforts in facilitating green and environmental work. They should actively get engaged in forums and activities on industrial green and low-carbon development, sharing and promoting successful practices and cases so as to offer references for different sectors in advancing green transformation.

(3) An active response to the calls of the government and a lack of response to social concerns

A review of the disclosure rates of different stakeholder-related indicators shows that listed financial companies in Shanghai report the highest disclosure rate in responses to the governments, which makes up 67.86%. The disclosure rates of responses to media reaches 57.14%, to regulators, 53.57%, to peers, 52.38%, to investors, 50%, to employees, 48.21%, to customers, 44.05%, all surpassing 40% and are relatively high. By contrast, their disclosure rates of responses to communities only stands at 33.93%, to suppliers, 28.57%, to financial institutions, 25%, and to civil societies, 22.62%, which are relatively low, and call for more attention and improvement in this regard.

Ⅲ. Four suggestions for financial enterprises in Shanghai

(1) Follow the new requirements and improve the quality of ESG disclosure

Financial enterprises in Shanghai are the trailblazers, explorers and practitioners of ESG philosophy. They should take initiatives to adapt to and align with the new requirements for ESG disclosure, lay out plans in advance and strengthen management, disclose ESG information comprehensively, render the information disclosed more transparent and reliable, and respond to the improving ESG ecosystem in a undisturbed manner.

(2) Deeply fit into the ESG philosophy and join hands in building “the five key pillars”

Financial enterprises in Shanghai should play a key role in expanding their business to “promoting the five key pillars of sci-tech finance, green finance, inclusive finance, elderly-care finance and digital finance” based on their advantages. Meanwhile, they should plan for and deploy the action plans in an overall manner under the framework of ESG standards, taking into consideration the comprehensive benefits of economy, society and environment.

(3) Align with the top-notch practices and address the weak links in ESG management

With the purpose of achieving high-quality development, financial enterprises in Shanghai should stay committed to adopting high standards and fully borrow experience from the ESG management philosophy and best practices of the first-class enterprises in China and the world. They should locate their shortages, address their weak links,and carry forward their strengths. Just as the adage goes, a stone taken from another mountain may serve as a tool to polish the local jade. Financial enterprises in Shanghai should be keen to learn from others and develop ESG management modes with their own characteristics, which can be taken as a starting point to improve ESG management. Enterprises should also enhance their ability to resist risks, competitiveness, innovation, and influence, offer valuable experience and guidance to the peers, and maintain their leading position in developing ESG, so as to contribute to a greener, fairer, and more transparent business environment.,

(4) Strengthen information transparency and build bridges of trust among stakeholders

Financial enterprises in Shanghai should comprehensively identify their relevant stakeholders, establish effective communication channels and mechanisms, maintain positive and harmonious relationships, enlarge their circle of friends, and identify the major needs of stakeholders. They should seek opportunities for mutual benefits and use them as driving forces to improve their ESG performance, coordinate resources and staff, and develop strategies targeting specific ESG issues. ESG information and data should be disclosed in a timely, accurate, and comprehensive manner by conducting quantitative and qualitative analysis to promote the transparency and authenticity of the information disclosed and to systematically present the implementation and significant outcomes of the actions taken by enterprises. Enterprises should keep on tracking and improving information disclosure, achieve convergence of interests in development, and foster close bonds with stakeholders to gain their recognition and supports.

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号