Home > Knowledge > CSR Research >

GoldenBee Research on CSR Reporting in China 2017 released

2017-12-18GoldenBeeadmin0010

On December 1, GoldenBee Research on Corporate Social Responsibility Reporting in China 2017 (hereinafter referred to as “the Research”) was released during the 10th International Conference on CSR Reporting in China.

The Research is based on the “GoldenBee Corporate Social Responsibility Report Assessment System 2017” (hereinafter referred to as “GBEE-CRAS2017”), and draws on some Chinese and foreign social responsibility report assessment system for references. As of now, there are 16,778 reports collected, and 10,146 reports have been included in the assessment in a decade.

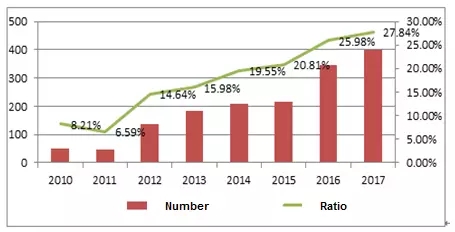

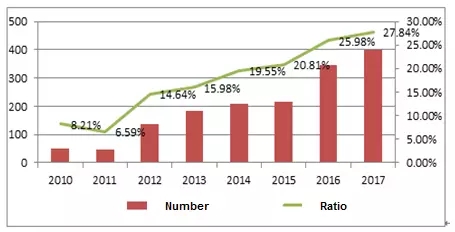

The overall level of reports shows stepwise improvement. The number of high-quality reports keeps rapid increase, with more than 25% of the reports achieving “good” rating and above.

From 2009 to 2017, the level of CSR reporting in China shows stepwise improvement. It is at the benchmark level in the period of the 11th Five-Year Plan and shows an average annual increase of 20% and 30% during the periods of the 12th Five-Year Plan and the first two years of the 13th Five-Year Plan, respectively.

As the increasing momentum in 2016 continues, the number of reports with an above “good” rating increases rapidly to 399 in 2017, accounting for 27.8% of all the reports. A significant number of reports with an “good” rating are produced by enterprises in storage and transport, mining, comprehensive, power, coal and water production and supply, and construction industries, accounting for 52.11%, 42.12%, 40.74%, 40.66%, 34.78% respectively of all the reports in their own industry. There is no report achieving above “good” rating in cultural communication industry. It is the only industry in which the overall quality of the reports is at “infant” level.

Number and Ratio of reports rated above “good”

02

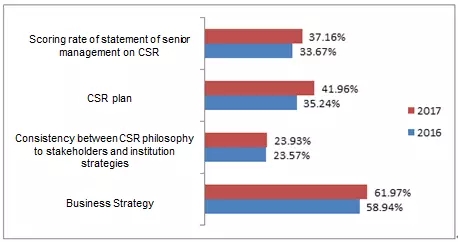

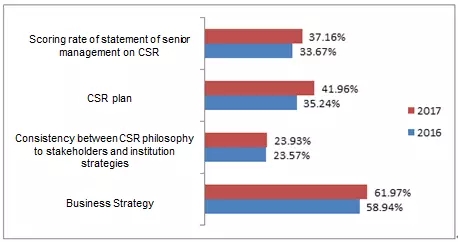

Enterprises pay more attention to the disclosure of CSR strategy and plan. Information about the seven stakeholders, namely customers, employees, environment, communities, shareholders, suppliers and government, is more sufficiently disclosed in business strategy, among which disclosure of communities is rising prominently.

In 2017, there is an increase in the percentage of enterprises disclosing the CSR awareness of senior management, the business strategy and the CSR plan, accounting for 37.16%, 61.97%, 41.96% respectively. The number of enterprises disclosing the CSR plan rises by 14.36% year-on-year. It suggests that more enterprises start to consider the strategic significance of CSR as a whole, make CSR annual plan and manage CSR work systemically.

Information about stakeholders disclosed in the business strategy shows a centralized tendency. In 2017, the disclosure of business strategy mainly covers seven stakeholders, namely customers, employees, environment, communities, shareholders, suppliers and government. The coverage rates of information on counterparts, supervisory institutions, social organizations, media and financial institutions are relatively lower, all below 10%. Compared with 2016, there is a significant rise in the coverage rate of community indicator. It indicates that apart from the interests of shareholders, enterprises start to pay more attention to the expectations and demands of other stakeholders related to the business operation, and take them into strategic consideration.

Indicators coverage rates of CSR strategy and planning

03

Innovation and readability of the reports continue to be emphasized in the reporting process, and materiality, completeness and comparability of reports keep stable improvement. The credibility remains low and gets slightly lower compared with the earlier years.

In 2017, the innovativeness and readability of reports continue to be emphasized, the indexes of which remain relatively high. Indexes of materiality, completeness and comparability keep stable improvement. This shows that enterprises are increasingly aware of the role of reports in internal and external communication to gain more attention from all sectors of the society. With concise text and rich charts and figures, the reports show enterprises’ CSR concepts, practices and performance. Following the current trends, the content and design of reports highlight industrial characteristics, and present corporate development concepts and culture. Some leading enterprises keep up with the new trends and include China’ s new innovative, coordinated, green, open, and shared development model, the Belt and Road Initiative and SDGs in the reports.

The credibility index continues to be relatively lower. Though almost 90% of enterprises present their CSR practices with a neutral and objective tone, there are only 24.27% of reports disclosing negative information, 42.26% disclosing stakeholder panel opinion, and 10.53% disclosing CSR expert opinion and third-party evaluation. The percentage of reports with stakeholder panel opinion is higher. It suggests that enterprises emphasize the role of reports in communication with stakeholders, and care about their evaluation and opinions about CSR. Compared with other enterprises, the credibility indexes of SOEs, foreign-invested and Hong Kong, Macao and Taiwan enterprises achieve higher scores.

Indexes of credibility, readability and innovativeness from 2009 to 2017

The information disclosure of stakeholders is highly consistent with the corporate strategy. The sufficient information about CSR fulfillment to employees, government, communities, environment, customers, shareholders, and supervisory institutions is disclosed. The information disclosure of government and supervisory institutions achieves a higher rating than that of business strategy. Reports place emphasis on disclosing information about stakeholders that are more relevant to the business strategy.

As shown in finding No. 2, major stakeholders in business strategy include customers, employees, environment, communities, shareholders, suppliers and government. This is highly consistent with better stakeholder information disclosure on employees, government, communities, environment, customers, shareholders, and supervisory institutions. However, the indicator ranking in information disclosure of government and supervisory institutions is higher than that of business strategy. This can be accounted by business strategy’ s high correlation with government policies and development strategies, and the requirements of government and supervisory institutions on CSR disclosure.

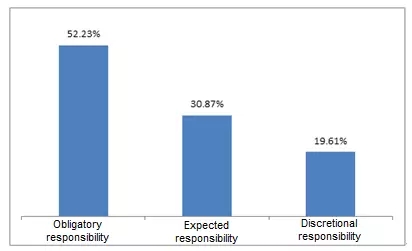

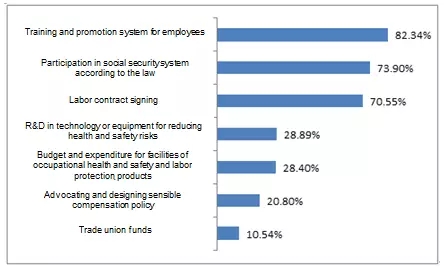

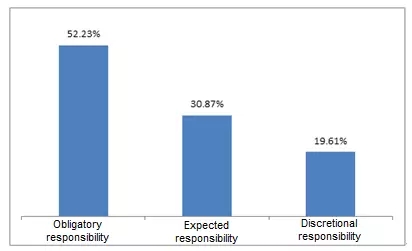

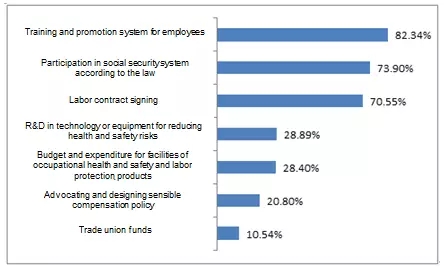

The information disclosure coverage rates of enterprises' obligatory responsibility, expected responsibility and discretional responsibility account for 52.23%, 30.87% and 19.61% respectively in a descending order. Take the information disclosure of employees as an example, the top three indicators, namely, the “training and promotion system for employees”, “participation in social security system according to the law” and “labor contract signing”, get scoring rates of 82.34%, 73.90% and 70.55% respectively. It shows that enterprises generally attach much importance to disclosing information that employees are most concerned about, such as career development and their basic rights and interests. But the disclosure of higher-level CSR information is insufficient, such as “advocating and designing sensible compensation policy”, “R&D in technology or equipment for reducing health and safety risks”, and expenditure.

Information disclosure coverage rates of obligatory responsibility, expected responsibility and discretional responsibility

Coverage rates of some indicators of employees

05

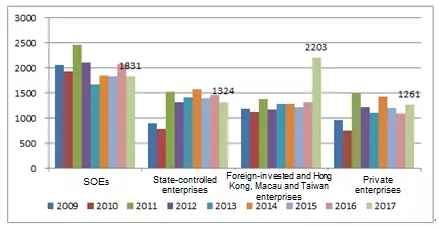

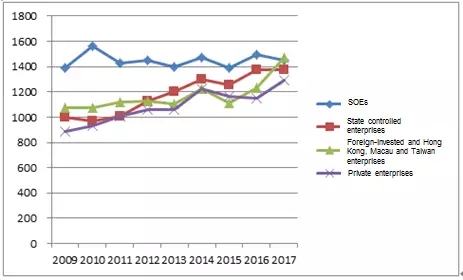

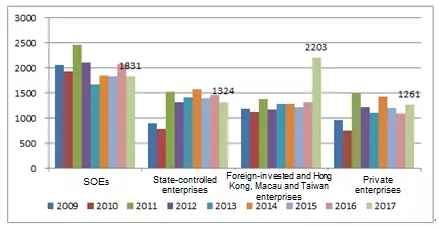

The reports of SOEs show stable improvement. Report quality improves rapidly in state-controlled enterprises, foreign-invested and Hong Kong, Macao and Taiwan enterprises, while private enterprises are catching up. In terms of innovativeness, readability and credibility, reports released by leading enterprises and growing enterprises still have a long way to go, while the gap in comprehensive index is narrowed.

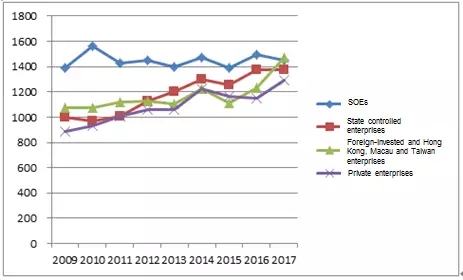

From 2009 to 2017, the comprehensive index of SOEs has been keeping holding the lead, showing stable and high-level development. In 2017, the comprehensive index of foreign-invested and Hong Kong, Macao and Taiwan enterprises and that of private enterprises rise substantially by 19.68% and 12.53% respectively year on year. Due to the rapid increases in comprehensive indexes of state-controlled enterprises and foreign-invested and Hong Kong, Macao and Taiwan enterprises, the gaps ofcomprehensive indexes become narrowed in comparison with that of SOEs. Private enterprises continue to get the lowest comprehensive index, but they show a strong momentum and keep catching up.

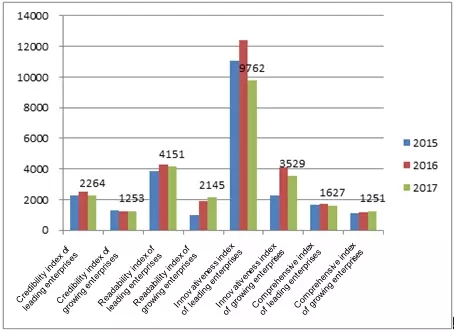

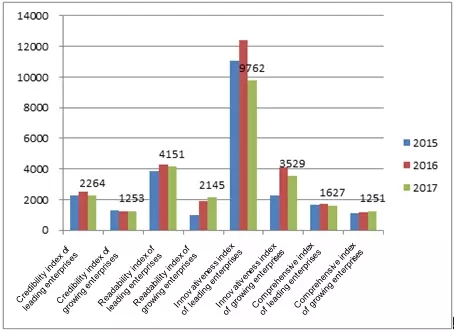

The quality of leading enterprises’ CSR report is still ahead of that of growing enterprises, but the gap between them has narrowed. Compared with growing enterprises, leading enterprises achieve higher scores in all indexes, especially in credibility index, readability index and innovative index.

Comprehensive indexes of enterprises of different ownerships

Credibility, readability, innovativeness, and comprehensive indexes of enterprises of different types

06

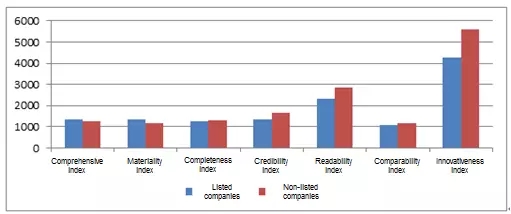

The comprehensive index of listed companies is slightly higher than that of non-listed companies. Listed companies achieve higher average scores in indicators of shareholders, financing institutions and supervisory institutions. The average score of enterprises listed on HKEX is 25.59% and 25.34% higher than that of SSE and SZSE respectively for its better disclosure of environment and supplier information.

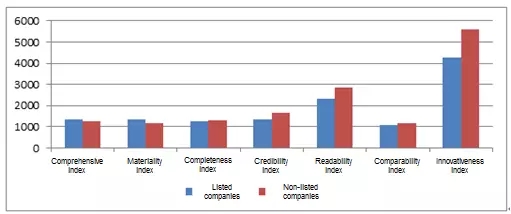

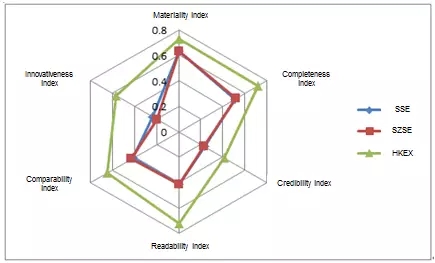

In 2017, the comprehensive index of listed companies is slightly higher than that of non-listed companies, with a better performance in materiality and higher scoring rates in indicators, such as shareholders, financial institutions and supervisory institutions. Compared with listed companies, non-listed companies are more flexible in report compilation with a better performance in readability and innovativeness.

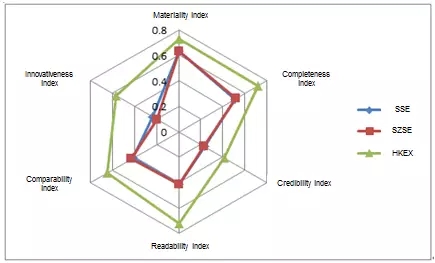

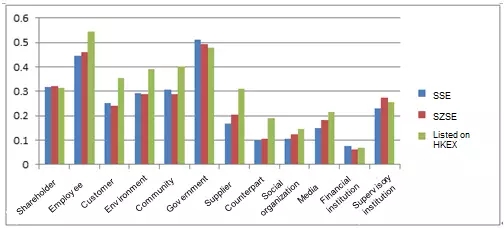

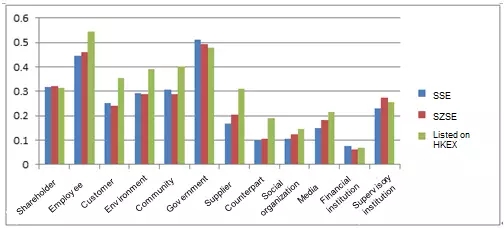

The average score for reports of enterprises listed on HKEX is 25.59% and 25.34% higher than that of SSE and SZSE respectively. With a higher scoring rate in indexes of completeness, credibility, readability, comparability, and innovativeness, HKEX listed enterprises place greater emphasis on information disclosure of stakeholders, such as the environment, employees, suppliers, communities, and counterparts. Thanks to the adoption of HKEX Environmental, Social and Governance (ESG) Reporting Guide (the ESG Guide or Guide), it provides specifications and guidance on CSR information disclosure for HKEX listed enterprises, making the information disclosure more normative and easier for stakeholders to understand non-financial information of enterprises.

Indexes of listed companies and non-listed companies

Indexes comparison among reports of companies listed on SSE, SZSE and HKEX

Coverage rates of stakeholders indicators in listed companies on SSE, SZSE and HKEX

07

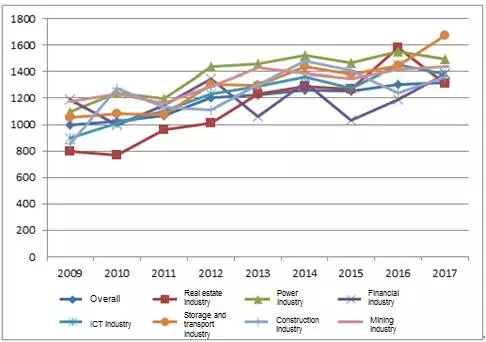

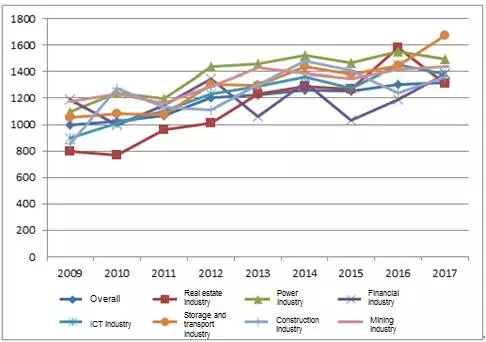

Reports of storage and transport, power and mining industries are of a relatively high quality, with power industry holding the lead. There is a prominent increase in the comprehensive index of reports of financial, storage and transport and construction industries. Each industry places particular emphasis on the information disclosure of stakeholders.

In 2017, the storage and transport, mining, and power industries are the top three industries based on the score of comprehensive index, with total average score of 69.18, 59.38 and 55.97 respectively. Power industry keeps publishing high quality reports, and issues a series of white papers on CSR as well. The comprehensive index for financial, storage and transport and construction industry reports rises by 16.65%, 15.91% and 9.51% respectively. Financial industry further improves the form and materiality of reports, with a substantial improvement in the scoring rates of employees, customers and environment.

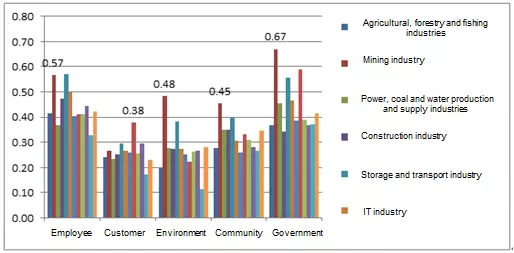

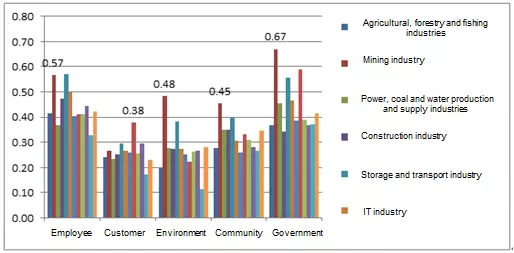

There is difference in the coverage rate of stakeholder indicators as the industry varies, which shows certain industrial characteristics. Mining industry achieves a higher scoring rate in information disclosure of communities, government, employees and environment. The storage and transport industry has a higher scoring rate of counterparts. As for financial industry, the information disclosure of customers, media and supervisory institutions achieves a higher scoring rate.

Comprehensive indexes of different industries

Scoring rates of employee, customer, environment, community and government in major industries

08

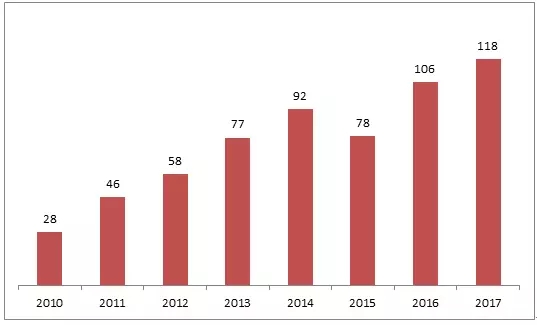

The level of internationalization of the reports keeps the same with that of last year. The number of English reports is on the rise, while the number of reports compiled in accordance with international CSR standards has slightly declined. Some enterprises pioneers published country reports or the CSR reports of overseas projects.

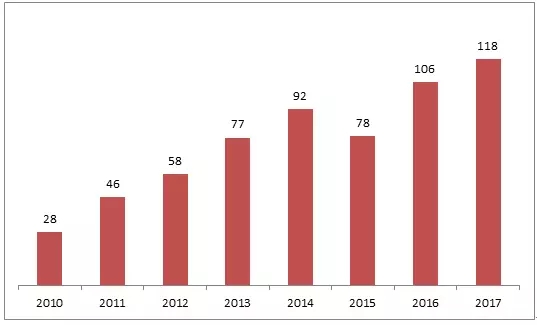

In 2017, the English reports keeps rising with a total number of 118, while the number of reports compiled in accordance with international CSR standards including GRI, UN Global Contract and ISO 26000 has declined. Several enterprises pioneers in “Going Global” have published country reports or the CSR reports of overseas projects, such as the CSR Report on China-Myanmar Oil and Gas Pipelines made by China National Petroleum Corporation (CNPC), CSR Report of China Southern Power Grid in Laos by China Southern Power Grid Co., Ltd. (CSG), and 2016 CSR Report of Mombasa-Nairobi SGR Project by China Road and Bridge Corporation (CRBC), and China Wu Yi (Kenya Branch) CSR Report 2016 by China Wu Yi Co., Ltd. These reports pay special attention to disclosing the social responsibility concepts, practices and performance of host countries.

Number of English Reports from 2010 to 2017

Number of reports compiled in accordance with international CSR standards

Insights from the Research

01

Regulate and guide the CSR reporting, and make it be a mandatory routine to improve report quantity and quality.

Thanks to the efforts of the government, supervisory institutions and industry organizations, the quantity and quality of CSR reports in China keep improving. However, the ratio of about 2000 reports to 20 million enterprises is disproportionately low. Reports show different levels of quality, and the information disclosure quality still needs to be improved.

The ESG Guide issued by HKEX specifies requirements for the environmental, social and governance information, urging enterprises to provide training and introduction to ESG Guide. As a result, report quality has improved rapidly. The government, supervisory institutions and industry organizations should further regulate and guide the reporting preparation to improve report quantity and quality substantially.

Deepen enterprises’ understanding of the CSR strategy, and further improve the consistency between the quality of CSR information disclosure and the business strategy.

As shown in the published CSR reports, enterprises are more aware of the strategic importance of stakeholders including customers, employees, environment, communities, shareholders, suppliers and government. The information disclosure of stakeholders in reports is sufficient and consistent with the business strategy, but it is not consistent enough. Enterprises should further enhance the disclosure quality and depth of information on stakeholders and improve the information disclosure of other stakeholders, such as counterparts, supervisory institutions, financial institutions and social organizations.

Leverage the advantages in innovativeness and readability, strengthen the communication with stakeholders, enhance the comparability in vertical (industry) level and horizontal (cross-industry) level, and improve the credibility.

With the advantages in innovativeness and readability, the reports should also include currents trends and present characteristics of the industry and the enterprise in report content and structure. In this case, reports can play a better role in enhancing the interaction between enterprises and stakeholders. Based on the advantages in innovativeness and readability, enterprises should enhance interactions with stakeholders during reporting preparation, thereby understanding and disclosing information that stakeholders concern. By receiving feedback from the stakeholders and disclosing cross-year performance comparison and the comparison with the average level of counterparts, enterprises can improve the authority and validity of reports.

Set leading enterprises and high-quality reports as good examples to encourage communication during CSR reporting preparation and improve the overall quality of reports.

Leading enterprises continues to set a good example with increasing number of reports with an above “good” rating. China’ s top 500 enterprises should deepen their understanding of the CSR and recognize the importance of releasing CSR reports, learn the CSR reporting experience from the international first-class enterprises and counterparts, and foster the reform and development of business operation by reporting. Enterprises should strengthen exchanges about CSR reporting, share experience in reporting preparation, data collection and analysis, and data review to further improve the overall level of CSR reporting. As different industries place emphasis on different stakeholders in the disclosure, they should improve the disclosure quality and depth of information on all the stakeholders by sharing communication and management experience related to stakeholders.

Take measures to raise the awareness of stakeholders and society on CSR reporting, and encourage them to make joint efforts with enterprises to promote social and economic sustainable development.

It is important for enterprises to enhance interaction with stakeholders and create a responsible corporate image to promote CSR reporting process. Enterprises should take measures to raise the awareness on the importance of CSR reporting of all sectors of society including consumers, customers, employees and media. The government, supervisory institutions and industry organizations should guide and encourage CSR reporting, and motivate enterprises to release CSR reports actively, thus creating a good business environment with better CSR fulfillment and promoting the sustainable development of society and economy.

Increase the number of reports compiled in accordance with international CSR standards to give full play to the role of CSR as a new international business language.

As China' s international influence grows, enterprises in China are more and more involved in the world market. Enterprises should refer to the international social responsibility standards and guidance in CSR reporting preparation. Reports should disclose the response to and implementation of international goals and China’ s policies, such as SDGs and the Belt and Road Initiative. Large enterprises and experienced “Going Global” enterprises should consider publishing country reports and CSR reports on a specific project and targeting local stakeholders in countries where they have operations to enhance interaction with the region and engage in local development.

The Research is based on the “GoldenBee Corporate Social Responsibility Report Assessment System 2017” (hereinafter referred to as “GBEE-CRAS2017”), and draws on some Chinese and foreign social responsibility report assessment system for references. As of now, there are 16,778 reports collected, and 10,146 reports have been included in the assessment in a decade.

Major findings in the Research

01

01

The overall level of reports shows stepwise improvement. The number of high-quality reports keeps rapid increase, with more than 25% of the reports achieving “good” rating and above.

From 2009 to 2017, the level of CSR reporting in China shows stepwise improvement. It is at the benchmark level in the period of the 11th Five-Year Plan and shows an average annual increase of 20% and 30% during the periods of the 12th Five-Year Plan and the first two years of the 13th Five-Year Plan, respectively.

As the increasing momentum in 2016 continues, the number of reports with an above “good” rating increases rapidly to 399 in 2017, accounting for 27.8% of all the reports. A significant number of reports with an “good” rating are produced by enterprises in storage and transport, mining, comprehensive, power, coal and water production and supply, and construction industries, accounting for 52.11%, 42.12%, 40.74%, 40.66%, 34.78% respectively of all the reports in their own industry. There is no report achieving above “good” rating in cultural communication industry. It is the only industry in which the overall quality of the reports is at “infant” level.

Number and Ratio of reports rated above “good”

02

Enterprises pay more attention to the disclosure of CSR strategy and plan. Information about the seven stakeholders, namely customers, employees, environment, communities, shareholders, suppliers and government, is more sufficiently disclosed in business strategy, among which disclosure of communities is rising prominently.

In 2017, there is an increase in the percentage of enterprises disclosing the CSR awareness of senior management, the business strategy and the CSR plan, accounting for 37.16%, 61.97%, 41.96% respectively. The number of enterprises disclosing the CSR plan rises by 14.36% year-on-year. It suggests that more enterprises start to consider the strategic significance of CSR as a whole, make CSR annual plan and manage CSR work systemically.

Information about stakeholders disclosed in the business strategy shows a centralized tendency. In 2017, the disclosure of business strategy mainly covers seven stakeholders, namely customers, employees, environment, communities, shareholders, suppliers and government. The coverage rates of information on counterparts, supervisory institutions, social organizations, media and financial institutions are relatively lower, all below 10%. Compared with 2016, there is a significant rise in the coverage rate of community indicator. It indicates that apart from the interests of shareholders, enterprises start to pay more attention to the expectations and demands of other stakeholders related to the business operation, and take them into strategic consideration.

Indicators coverage rates of CSR strategy and planning

03

Innovation and readability of the reports continue to be emphasized in the reporting process, and materiality, completeness and comparability of reports keep stable improvement. The credibility remains low and gets slightly lower compared with the earlier years.

In 2017, the innovativeness and readability of reports continue to be emphasized, the indexes of which remain relatively high. Indexes of materiality, completeness and comparability keep stable improvement. This shows that enterprises are increasingly aware of the role of reports in internal and external communication to gain more attention from all sectors of the society. With concise text and rich charts and figures, the reports show enterprises’ CSR concepts, practices and performance. Following the current trends, the content and design of reports highlight industrial characteristics, and present corporate development concepts and culture. Some leading enterprises keep up with the new trends and include China’ s new innovative, coordinated, green, open, and shared development model, the Belt and Road Initiative and SDGs in the reports.

The credibility index continues to be relatively lower. Though almost 90% of enterprises present their CSR practices with a neutral and objective tone, there are only 24.27% of reports disclosing negative information, 42.26% disclosing stakeholder panel opinion, and 10.53% disclosing CSR expert opinion and third-party evaluation. The percentage of reports with stakeholder panel opinion is higher. It suggests that enterprises emphasize the role of reports in communication with stakeholders, and care about their evaluation and opinions about CSR. Compared with other enterprises, the credibility indexes of SOEs, foreign-invested and Hong Kong, Macao and Taiwan enterprises achieve higher scores.

Indexes of credibility, readability and innovativeness from 2009 to 2017

Credibility indexes of enterprises of different ownerships

04

04

The information disclosure of stakeholders is highly consistent with the corporate strategy. The sufficient information about CSR fulfillment to employees, government, communities, environment, customers, shareholders, and supervisory institutions is disclosed. The information disclosure of government and supervisory institutions achieves a higher rating than that of business strategy. Reports place emphasis on disclosing information about stakeholders that are more relevant to the business strategy.

As shown in finding No. 2, major stakeholders in business strategy include customers, employees, environment, communities, shareholders, suppliers and government. This is highly consistent with better stakeholder information disclosure on employees, government, communities, environment, customers, shareholders, and supervisory institutions. However, the indicator ranking in information disclosure of government and supervisory institutions is higher than that of business strategy. This can be accounted by business strategy’ s high correlation with government policies and development strategies, and the requirements of government and supervisory institutions on CSR disclosure.

The information disclosure coverage rates of enterprises' obligatory responsibility, expected responsibility and discretional responsibility account for 52.23%, 30.87% and 19.61% respectively in a descending order. Take the information disclosure of employees as an example, the top three indicators, namely, the “training and promotion system for employees”, “participation in social security system according to the law” and “labor contract signing”, get scoring rates of 82.34%, 73.90% and 70.55% respectively. It shows that enterprises generally attach much importance to disclosing information that employees are most concerned about, such as career development and their basic rights and interests. But the disclosure of higher-level CSR information is insufficient, such as “advocating and designing sensible compensation policy”, “R&D in technology or equipment for reducing health and safety risks”, and expenditure.

Information disclosure coverage rates of obligatory responsibility, expected responsibility and discretional responsibility

Coverage rates of some indicators of employees

05

The reports of SOEs show stable improvement. Report quality improves rapidly in state-controlled enterprises, foreign-invested and Hong Kong, Macao and Taiwan enterprises, while private enterprises are catching up. In terms of innovativeness, readability and credibility, reports released by leading enterprises and growing enterprises still have a long way to go, while the gap in comprehensive index is narrowed.

From 2009 to 2017, the comprehensive index of SOEs has been keeping holding the lead, showing stable and high-level development. In 2017, the comprehensive index of foreign-invested and Hong Kong, Macao and Taiwan enterprises and that of private enterprises rise substantially by 19.68% and 12.53% respectively year on year. Due to the rapid increases in comprehensive indexes of state-controlled enterprises and foreign-invested and Hong Kong, Macao and Taiwan enterprises, the gaps ofcomprehensive indexes become narrowed in comparison with that of SOEs. Private enterprises continue to get the lowest comprehensive index, but they show a strong momentum and keep catching up.

The quality of leading enterprises’ CSR report is still ahead of that of growing enterprises, but the gap between them has narrowed. Compared with growing enterprises, leading enterprises achieve higher scores in all indexes, especially in credibility index, readability index and innovative index.

Comprehensive indexes of enterprises of different ownerships

Credibility, readability, innovativeness, and comprehensive indexes of enterprises of different types

06

The comprehensive index of listed companies is slightly higher than that of non-listed companies. Listed companies achieve higher average scores in indicators of shareholders, financing institutions and supervisory institutions. The average score of enterprises listed on HKEX is 25.59% and 25.34% higher than that of SSE and SZSE respectively for its better disclosure of environment and supplier information.

In 2017, the comprehensive index of listed companies is slightly higher than that of non-listed companies, with a better performance in materiality and higher scoring rates in indicators, such as shareholders, financial institutions and supervisory institutions. Compared with listed companies, non-listed companies are more flexible in report compilation with a better performance in readability and innovativeness.

The average score for reports of enterprises listed on HKEX is 25.59% and 25.34% higher than that of SSE and SZSE respectively. With a higher scoring rate in indexes of completeness, credibility, readability, comparability, and innovativeness, HKEX listed enterprises place greater emphasis on information disclosure of stakeholders, such as the environment, employees, suppliers, communities, and counterparts. Thanks to the adoption of HKEX Environmental, Social and Governance (ESG) Reporting Guide (the ESG Guide or Guide), it provides specifications and guidance on CSR information disclosure for HKEX listed enterprises, making the information disclosure more normative and easier for stakeholders to understand non-financial information of enterprises.

Indexes of listed companies and non-listed companies

Indexes comparison among reports of companies listed on SSE, SZSE and HKEX

Coverage rates of stakeholders indicators in listed companies on SSE, SZSE and HKEX

07

Reports of storage and transport, power and mining industries are of a relatively high quality, with power industry holding the lead. There is a prominent increase in the comprehensive index of reports of financial, storage and transport and construction industries. Each industry places particular emphasis on the information disclosure of stakeholders.

In 2017, the storage and transport, mining, and power industries are the top three industries based on the score of comprehensive index, with total average score of 69.18, 59.38 and 55.97 respectively. Power industry keeps publishing high quality reports, and issues a series of white papers on CSR as well. The comprehensive index for financial, storage and transport and construction industry reports rises by 16.65%, 15.91% and 9.51% respectively. Financial industry further improves the form and materiality of reports, with a substantial improvement in the scoring rates of employees, customers and environment.

There is difference in the coverage rate of stakeholder indicators as the industry varies, which shows certain industrial characteristics. Mining industry achieves a higher scoring rate in information disclosure of communities, government, employees and environment. The storage and transport industry has a higher scoring rate of counterparts. As for financial industry, the information disclosure of customers, media and supervisory institutions achieves a higher scoring rate.

Comprehensive indexes of different industries

Scoring rates of employee, customer, environment, community and government in major industries

08

The level of internationalization of the reports keeps the same with that of last year. The number of English reports is on the rise, while the number of reports compiled in accordance with international CSR standards has slightly declined. Some enterprises pioneers published country reports or the CSR reports of overseas projects.

In 2017, the English reports keeps rising with a total number of 118, while the number of reports compiled in accordance with international CSR standards including GRI, UN Global Contract and ISO 26000 has declined. Several enterprises pioneers in “Going Global” have published country reports or the CSR reports of overseas projects, such as the CSR Report on China-Myanmar Oil and Gas Pipelines made by China National Petroleum Corporation (CNPC), CSR Report of China Southern Power Grid in Laos by China Southern Power Grid Co., Ltd. (CSG), and 2016 CSR Report of Mombasa-Nairobi SGR Project by China Road and Bridge Corporation (CRBC), and China Wu Yi (Kenya Branch) CSR Report 2016 by China Wu Yi Co., Ltd. These reports pay special attention to disclosing the social responsibility concepts, practices and performance of host countries.

Number of English Reports from 2010 to 2017

Number of reports compiled in accordance with international CSR standards

Insights from the Research

01

Regulate and guide the CSR reporting, and make it be a mandatory routine to improve report quantity and quality.

Thanks to the efforts of the government, supervisory institutions and industry organizations, the quantity and quality of CSR reports in China keep improving. However, the ratio of about 2000 reports to 20 million enterprises is disproportionately low. Reports show different levels of quality, and the information disclosure quality still needs to be improved.

The ESG Guide issued by HKEX specifies requirements for the environmental, social and governance information, urging enterprises to provide training and introduction to ESG Guide. As a result, report quality has improved rapidly. The government, supervisory institutions and industry organizations should further regulate and guide the reporting preparation to improve report quantity and quality substantially.

02

Deepen enterprises’ understanding of the CSR strategy, and further improve the consistency between the quality of CSR information disclosure and the business strategy.

As shown in the published CSR reports, enterprises are more aware of the strategic importance of stakeholders including customers, employees, environment, communities, shareholders, suppliers and government. The information disclosure of stakeholders in reports is sufficient and consistent with the business strategy, but it is not consistent enough. Enterprises should further enhance the disclosure quality and depth of information on stakeholders and improve the information disclosure of other stakeholders, such as counterparts, supervisory institutions, financial institutions and social organizations.

03

Leverage the advantages in innovativeness and readability, strengthen the communication with stakeholders, enhance the comparability in vertical (industry) level and horizontal (cross-industry) level, and improve the credibility.

With the advantages in innovativeness and readability, the reports should also include currents trends and present characteristics of the industry and the enterprise in report content and structure. In this case, reports can play a better role in enhancing the interaction between enterprises and stakeholders. Based on the advantages in innovativeness and readability, enterprises should enhance interactions with stakeholders during reporting preparation, thereby understanding and disclosing information that stakeholders concern. By receiving feedback from the stakeholders and disclosing cross-year performance comparison and the comparison with the average level of counterparts, enterprises can improve the authority and validity of reports.

04

Set leading enterprises and high-quality reports as good examples to encourage communication during CSR reporting preparation and improve the overall quality of reports.

Leading enterprises continues to set a good example with increasing number of reports with an above “good” rating. China’ s top 500 enterprises should deepen their understanding of the CSR and recognize the importance of releasing CSR reports, learn the CSR reporting experience from the international first-class enterprises and counterparts, and foster the reform and development of business operation by reporting. Enterprises should strengthen exchanges about CSR reporting, share experience in reporting preparation, data collection and analysis, and data review to further improve the overall level of CSR reporting. As different industries place emphasis on different stakeholders in the disclosure, they should improve the disclosure quality and depth of information on all the stakeholders by sharing communication and management experience related to stakeholders.

05

Take measures to raise the awareness of stakeholders and society on CSR reporting, and encourage them to make joint efforts with enterprises to promote social and economic sustainable development.

It is important for enterprises to enhance interaction with stakeholders and create a responsible corporate image to promote CSR reporting process. Enterprises should take measures to raise the awareness on the importance of CSR reporting of all sectors of society including consumers, customers, employees and media. The government, supervisory institutions and industry organizations should guide and encourage CSR reporting, and motivate enterprises to release CSR reports actively, thus creating a good business environment with better CSR fulfillment and promoting the sustainable development of society and economy.

06

Increase the number of reports compiled in accordance with international CSR standards to give full play to the role of CSR as a new international business language.

As China' s international influence grows, enterprises in China are more and more involved in the world market. Enterprises should refer to the international social responsibility standards and guidance in CSR reporting preparation. Reports should disclose the response to and implementation of international goals and China’ s policies, such as SDGs and the Belt and Road Initiative. Large enterprises and experienced “Going Global” enterprises should consider publishing country reports and CSR reports on a specific project and targeting local stakeholders in countries where they have operations to enhance interaction with the region and engage in local development.

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号