ESG involvement of global stock exchanges

2022-05-19未知责任编辑0

Against by sluggish economic environment, severe climate change, and the COVID-19 epidemic spreading around the world, investors and enterprises have increasingly paid attention to sustainable development.

As the central cog in capital market operation, stock exchanges play a special role in ESG ecology. More stringent standard and constraints on ESG disclosure require listed companies to enhance their transparency and management to pursue a quality development for more resilient sustainability.

01

As a key link in the ESG ecological chain, stock exchanges have a unique position in the society, connecting investors, listed companies, intermediaries and other market parties, as well as serving securities trading, guiding capital flow and providing information.

1. Having the responsibility to establish trading rules to maintain market order as an important trading venue

Trading rules include disclosure rules, which guarantee investors' access to corporate information. Traditional investors' attention to the financial information makes listed enterprises focus more on the numbers, while with the rise of responsible investment, investors are more inclined to evaluate an enterprise from ESG perspective. Therefore, it is necessary for the exchange to formulate ESG disclosure rules to meet the information needs of investors.

2. Influencing the market capital flow due to its facilitation on free capital flow

The prevailing concept of sustainable development ignites a greater fund demand in "green" enterprises due to their urgent development needs. Stock exchanges have the responsibility to guide the capital flows to sustainable fields and serve qualified enterprise financing, so as to guide the overall resource allocation of the society.

3. Functioning as an important platform for investors to obtain cutting-edge information

With the growing market size of sustainable financial products, investors' demand for such information is increasing. The exchanges are expected to be an information platform for sharing sustainable concepts through consultation, publicity, training and other forms, to deliver cutting-edge sustainable information to investors.

1. Having the responsibility to establish trading rules to maintain market order as an important trading venue

Trading rules include disclosure rules, which guarantee investors' access to corporate information. Traditional investors' attention to the financial information makes listed enterprises focus more on the numbers, while with the rise of responsible investment, investors are more inclined to evaluate an enterprise from ESG perspective. Therefore, it is necessary for the exchange to formulate ESG disclosure rules to meet the information needs of investors.

2. Influencing the market capital flow due to its facilitation on free capital flow

The prevailing concept of sustainable development ignites a greater fund demand in "green" enterprises due to their urgent development needs. Stock exchanges have the responsibility to guide the capital flows to sustainable fields and serve qualified enterprise financing, so as to guide the overall resource allocation of the society.

3. Functioning as an important platform for investors to obtain cutting-edge information

With the growing market size of sustainable financial products, investors' demand for such information is increasing. The exchanges are expected to be an information platform for sharing sustainable concepts through consultation, publicity, training and other forms, to deliver cutting-edge sustainable information to investors.

02

The exchanges play a special role in connecting listed companies with investors and have the responsibility to lead sustainable development. The United Nations Sustainable Stock Exchanges Initiative (SSE) has emerged as a result of this common understanding that different stock exchanges should act together. The mission of the SSE is to provide a global platform to enhance the ESG performance of stock exchanges and encourage the sustainable investment by exploring ways in which they can collaborate with investors, companies (issuers), regulators, policy makers and relevant international organizations, including financing the UN SDGs.

1. Promoting more standardized ESG disclosure

In September 2015, SSE issued the Model Guidance on Reporting ESG to partner stock exchanges. The Guidance provides a template to help stock exchanges standardize ESG disclosure. Other exchanges can also use the model or template to develop customized guidelines that meet market needs. By November 2021, 60 of the 114 stock exchanges tracked by SSE had issued ESG reporting guidelines for their listed companies, with an overall completion of 53%.

However, ESG disclosure guidelines issued by most stock exchanges are not mandatory, making it more of a reference than a propelling force to implement. As of November 2021, only 26 of the 114 stock exchanges had issued mandatory ESG listing requirements, accounting for 23% of the total, far lower than the number of stock exchanges that issued guidelines.

To this end, SSE carried out relevant actions to help the exchange urge enterprises to actually implement the ESG disclosure guidelines, including coordinating with regulators. SSE shares the advanced rule setting through How Securities Regulators Can Support the Sustainable Development Goals - A Sharing of Experience, including disclosure rules of 13 countries. This move propels stock exchanges to urge listed companies to disclose ESG information with higher standards.

2. Supporting efforts related to climate change

The threats brought by climate change, such as frequent extreme weather and global warming, are directly or indirectly affecting our lives.

According to SSE statistics, among the 114 exchanges surveyed, 35 stock exchanges pay attention to the recommendations of Task Force on Climate-related Financial Disclosures (TCFD) in ESG guidelines, accounting for less than 30% of the total. Most listed companies lack the guidance and the standardization of management measures by the stock exchange. Therefore, exchanges should take relevant measures to help enterprises proactively deal with the challenges brought by climate change risks.

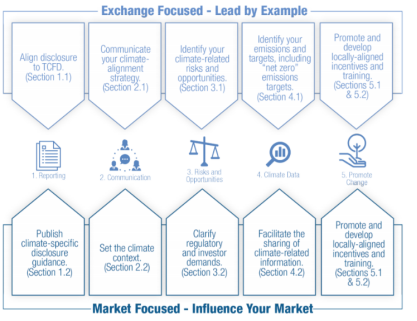

SSE issued the Model Guidance on Climate Disclosure in 2021 to assist stock exchanges in guiding their markets in climate-related information disclosure. Guided by the recommendations of the Financial Stability Board (FSB) and the TCFD, the Guidance provide texts that may be used to guide issuers, helping enterprises make climate disclosure in time and adapt to needs on climate-related market investment.

In 2021, SSE also published Action Plan to Make Markets Climate Resilient to provide a methodology for stock exchanges to influence the market through their actions.

1. Promoting more standardized ESG disclosure

In September 2015, SSE issued the Model Guidance on Reporting ESG to partner stock exchanges. The Guidance provides a template to help stock exchanges standardize ESG disclosure. Other exchanges can also use the model or template to develop customized guidelines that meet market needs. By November 2021, 60 of the 114 stock exchanges tracked by SSE had issued ESG reporting guidelines for their listed companies, with an overall completion of 53%.

However, ESG disclosure guidelines issued by most stock exchanges are not mandatory, making it more of a reference than a propelling force to implement. As of November 2021, only 26 of the 114 stock exchanges had issued mandatory ESG listing requirements, accounting for 23% of the total, far lower than the number of stock exchanges that issued guidelines.

To this end, SSE carried out relevant actions to help the exchange urge enterprises to actually implement the ESG disclosure guidelines, including coordinating with regulators. SSE shares the advanced rule setting through How Securities Regulators Can Support the Sustainable Development Goals - A Sharing of Experience, including disclosure rules of 13 countries. This move propels stock exchanges to urge listed companies to disclose ESG information with higher standards.

2. Supporting efforts related to climate change

The threats brought by climate change, such as frequent extreme weather and global warming, are directly or indirectly affecting our lives.

According to SSE statistics, among the 114 exchanges surveyed, 35 stock exchanges pay attention to the recommendations of Task Force on Climate-related Financial Disclosures (TCFD) in ESG guidelines, accounting for less than 30% of the total. Most listed companies lack the guidance and the standardization of management measures by the stock exchange. Therefore, exchanges should take relevant measures to help enterprises proactively deal with the challenges brought by climate change risks.

SSE issued the Model Guidance on Climate Disclosure in 2021 to assist stock exchanges in guiding their markets in climate-related information disclosure. Guided by the recommendations of the Financial Stability Board (FSB) and the TCFD, the Guidance provide texts that may be used to guide issuers, helping enterprises make climate disclosure in time and adapt to needs on climate-related market investment.

In 2021, SSE also published Action Plan to Make Markets Climate Resilient to provide a methodology for stock exchanges to influence the market through their actions.

▲The influence of stock exchanges' climate-related behaviors on their market

3. Incubating sustainable financial products

As global institutional investors gradually take ESG into account in their investment strategies, stock exchanges are also making positive responses and launching ESG related investment products to for investors.

The 2020 Green Bond Treasurer Survey released by the Climate Bonds Initiative (CBI) shows that 17 stock exchanges have offered dedicated green bond sections before 2020. The traditional ESG bond has now been extended to "GSSS", that is, green, social, sustainability and sustainability bond, which all fall into the category of green bonds in a broad sense.

As global institutional investors gradually take ESG into account in their investment strategies, stock exchanges are also making positive responses and launching ESG related investment products to for investors.

The 2020 Green Bond Treasurer Survey released by the Climate Bonds Initiative (CBI) shows that 17 stock exchanges have offered dedicated green bond sections before 2020. The traditional ESG bond has now been extended to "GSSS", that is, green, social, sustainability and sustainability bond, which all fall into the category of green bonds in a broad sense.

▲Stock exchanges issuing ESG related bonds in 2020 Green Bond Treasurer Survey

In 2017, SSE issued How Stock Exchanges can Grow Green Finance to build a self-examination list of 12 detailed rules and action plans in four areas on how to promote green finance in stock exchanges, of which the first area is to promote green products and services. According to SSE statistics, as of October 2021, 46 stock exchanges around the world have established ESG related bond sections.

Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) are also pushing forward green financial products. SSE developed the first sustainability investment product ETF in China in 2020, and SZSE has issued more than RMB 60 billion of green financial products as of August 2021. In addition, many stock exchanges in the world have launched display platforms for green financial products and ESG products.

03

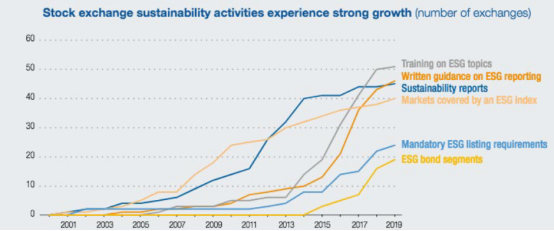

10 Years of Impact and Progress Report released by the SSE in 2019 shows that SSE has guided stock exchanges in sustainability, including six global dialogues, research partnerships with more than 200 organizations, and 53 professional trainings, which has contributed to the growth of their sustainability-related performance in the past decade.

In addition to the significant increase in the number of issued guidelines, it has seen an increase regarding ESG training, market coverage of the ESG index, ESG bond issuance, and sustainability report. SSE not only guides stock exchanges to have more involvement in ESG, but also achieves multiple values.

In addition to the significant increase in the number of issued guidelines, it has seen an increase regarding ESG training, market coverage of the ESG index, ESG bond issuance, and sustainability report. SSE not only guides stock exchanges to have more involvement in ESG, but also achieves multiple values.

▲10 Years of Impact and Progress Report - Growth of stock exchange sustainability activities experience

1. Promoting more standardized disclosure by listed companies

SSE urges listed companies on partner exchanges to disclose ESG information in accordance with the international common framework. As of December 2021, 95% of stock exchanges mentioned GRI in the disclosure guidelines, with SASB, IIRC, CDP and TCFD all exceeding 50%. Among the partner exchanges tracked by SSE, the largest difference in disclosure between listed companies conforming to international standards before and after the introduction of mandatory disclosure guidelines is the Johannesburg Stock Exchange in South Africa, where the proportion of listed companies disclosing ESG information based on the international common framework has increased from less than 10% to more than 70%.

2. Steering more funds to sustainable field

Guided by SSE, as of December 2021, there are 43 partner exchanges with sustainable bond listings. Taking the London Stock Exchange (LSE) as an example, it builds a sustainable bond market (SBM) and discloses its excellent performance in incubating sustainability-related financial products in the 2020 Sustainability Report. By end of December 2020, a total of 253 sustainable bonds were active in the SBM market and attracted more than £52.4 billion.

3. Developing tools for ESG practices

Based on the continuous tracking of the sustainable practices of the stock exchanges, the SSE has established three major databases, showing the key activities of 96 stock exchanges in promoting sustainable business and investment time, preserving more than 30 guiding documents issued by exchanges or regulators on how to report ESG information, and systematically counting the data on promoting gender equality between stock exchanges, etc., which is conducive to mutual reference between stock exchanges and advanced ESG practices.

In the post-pandemic era, the market will be full of uncertainty, but it is credible that ESG impact on the capital market will become increasingly prominent. As the central cog in the capital market, the ESG engagement by stock exchanges is guiding the entire market in a more sustainable direction.

It is expected that at the end of the next decade, the stock exchange will achieve more remarkable results through more ESG involvement.

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号