China's Listed Companies Carbon Transparency Report released

2022-03-10GoldenBeeGoldenBee0

Recently, the 2021 China's Listed Companies Carbon Transparency Report compiled by GoldenBee and JRJ.com (China Finance Online) has been officially released.

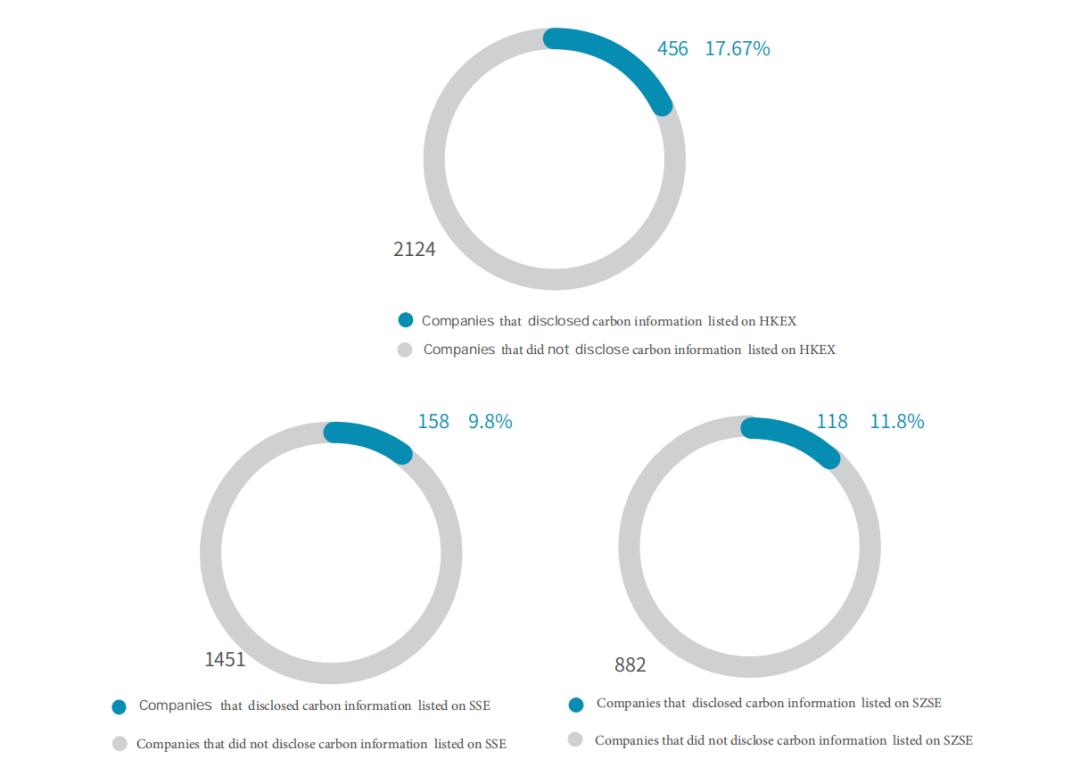

3,661 ESG, CSR or sustainability reports released in 2021 by companies listed on Hong Kong Exchange and Clearing(HKEX), Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) are analyzed to provide the deep insight of the disclosure on carbon emission, management and strategies of China’s listed companies under the guidance of China’s "30·60 decarbonization" policies and capital market rules.

Comparison of carbon disclosure in ESG reports of companies listed on HKEX, SSE, SZSE

According to the results of the report, the proportion of listed companies disclosing carbon information is generally low. A total of 732 companies disclosed information on climate change and carbon, accounting for about 20% of the total survey samples.

Among them, the active degree of carbon disclosure of companies listed on HKEX is significantly higher than that of SSE and SZSE. Of the 2,580 reports released by companies listed on HKEX, 18% included carbon disclosure.

The report believes that the HKEX’s "comply or explain" requirement on ESG reporting and the newly added "climate change" indicator have played a positive role in urging listed companies to disclose carbon information.

-

Extractive and power industries are more active in disclosing carbon emissions

Six indicators for analyzing corporate actions on climate change

The report provides a statistical analysis of corporate actions to address climate change from six aspects: policies/governance, risk/opportunity analysis and assessment, systematic response measures, target setting, disclosure, and initiative participation.

Generally speaking, companies perform better at goal setting, risk analysis and management, while initiative participation are just in their infancy.

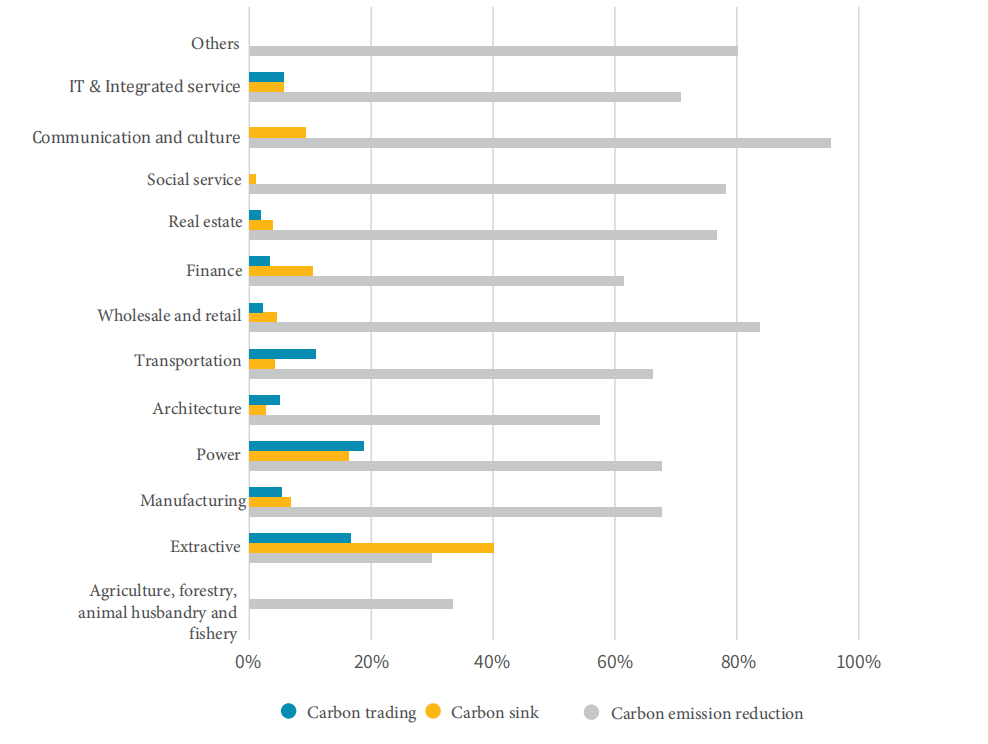

Judging from carbon disclosure, industries have varying degrees of exploration. Finance, real estate, and extractive industries are more active in target setting, risk analysis and management; finance and real estate industries are sensitive to regulatory policies and have performed well in carbon target setting, risk analysis and management; key industries such as extractive and power have given priority to exploring emission data disclosure, carbon emission reduction and carbon sink measures, for example, 33% extractive companies have disclosed carbon emission information.

This shows that as an important part of decarbonization on the supply side, the extractive and power industry in the energy supply chain have taken the lead in taking a key step towards the "30·60" decarbonization goal.

-

11 industries fully disclosed carbon reduction information

More than 50% of companies from 11 industries disclosed carbon reduction measures

The general disclosure of different sub-indicators reveals that different industries' disclosure on carbon reduction practices is far superior to that of carbon strategy and carbon management information.

Among them, companies are more active in disclosing systematic carbon reduction measures, with more than 50% of them in 11 industries disclosing their carbon-reducing measures, which indicates that companies are more experienced in energy-saving and emission-reducing management and practices. In contrast, they are not fully prepared for management indexes such as carbon neutrality target setting and climate risk analysis.

-

Expert opinion: Carbon management is about a company's future core competitiveness

Stressing carbon management is companies’ positive feedback to the changes in the evaluation mechanism of the capital market. Xing Jing, General Manager of the Center of Listed Company, JRJ.com said that, currently, more and more organizations use carbon management as an important indicator for evaluating corporate value. In the future, carbon management will become one of the core elements in corporate competitiveness.

Against national policy of "30·60" decarbonization goal, the process of incorporating carbon topics into the information disclosure of listed companies will be further accelerated. Dai Yibo, Vice President of GoldenBee Consulting, believes that for listed companies, carbon management is more than an environmental topic. Companies shall "go an extra mile" while embracing the compliance, use carbon management to trigger a sustainability-oriented transformation and increase chances of enhancing core competitiveness in the future.

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号