How to more directly convey useful ESG info to investors?

2022-02-28GoldenBeeGoldenBee0

"As we look out onto the next decade for ESG Ratings, having more data will be the easy part. The hard part – and the important part – will be knowing how to identify and apply the most relevant signal and achieve better-differentiated investment objectives". MSCI highlighted the use of ESG information in MSCI’s 2019 ESG TRENDS TO WATCH.

And according to a recent BlackRock survey, more than half (53%) of global respondents said concerns about "ESG information access and data quality" were the biggest obstacle to their sustainable investments.

This also urges companies to think about how to disclose and transmit their ESG information in a more timely and clear manner in the face of the multiple and exponential growth of ESG information, so that "relevant signals" can be captured by investors more directly and effectively.

This becomes another key to ESG disclosure.

01

ESG Disclosure ≠ ESG Report

The information capacity of the report is limited

To provide better ESG disclosure, listed companies should first identify what common forms of ESG disclosure are now.

At present, ESG disclosure is based on meeting the requirements of regulatory authorities. It is a popular choice for companies to refer to the guidelines and suggestions of ESG rule system of regulatory authorities for ESG reporting.

There is no doubt that releasing ESG report is the most mainstream way of ESG disclosure. However, can ESG reporting meet all ESG disclosure requirements and needs?

The answer is no. ESG reports may have the following limitations.

Lack of effectiveness

Listed companies usually disclose multiple ESG topics in their reports, but in terms of what information to disclose, it is usually decided by the company itself. These decisions are often more "self-interested" and "to sweep bad news under the carpet". Companies usually choose not to disclose some sensitive ESG information.

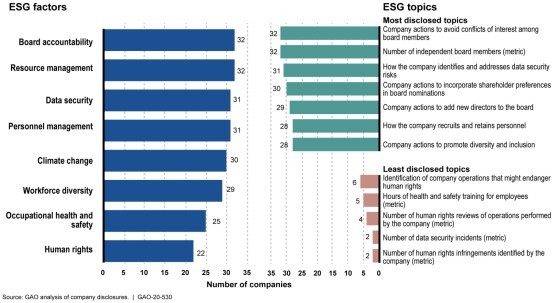

In terms of disclosure content, the lack of detail makes ESG information less useful to investors. For example, the most abundant information disclosed by companies is qualitative description of topics, while the least disclosed is quantitative indicators.

ESG factors and topics disclosure of listed companies (based on 2018 data, source: GAO)

Lack of timeliness

Most companies should already be aware that "materiality" in ESG is not a static concept, it changes dynamically.

For example, in the context of COVID-19 in 2020, systemic risks related to social and environmental change, such as public health and climate change, have been highlighted, and issues related to business continuity and supply chain stability have received increasing attention. In general, these significant ESG information also show up with sudden occurrence. From the perspective of information users, real-time updated ESG information is also required to support market judgment and investment decisions.

ESG reports are usually released annually, so is the information updates contained. In the "well-informed market", such information has undoubtedly become obsolete. ESG reports are obviously unable to meet the requirements of its high effectiveness.

Lack of comprehensiveness

Although companies analyze material topics in accordance with the principle of materiality during reporting preparation, due to the length of the report, topics that have long-term impact on companies, industries and social development are usually not the focuses of disclosure, such as carbon taxes, biodiversity management, sustainable consumption, etc. These topics often contain ESG risks and business opportunities that are overlooked by companies while highly regarded by keen investors.

For example, an HSBC survey shows that younger consumers of "millennials" (those born after 1980) and "Gen Z" (those born around 2000) are more willing to spend sustainably, suggesting that "investors should be aware of these evolving trends as they point to a case for opportunities in the sustainable consumption space".

Precisely because of its "non-materiality" in the short term, relevant ESG topics and richer details rarely appear in ESG reports.

02

The market prefers "multi-source" ESG info

Alternative data is more favored

For the above reasons, it is not difficult to find that market entities represented by ESG rating agencies are seeking additional ESG disclosure to make up for possible deficiencies in corporate ESG disclosure.

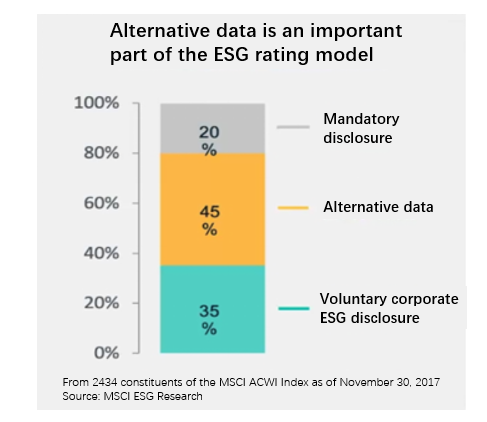

Data composition of the MSCI ESG rating model

In fact, almost all international rating agencies, including S&P CSA assessments, FTSE ESG ratings, Thomson Reuters, MSCI ESG ratings, etc., are seeking ESG alternative data to reduce their reliance on corporate disclosure.

Digital technologies make it a reality, and the application of "big data" enables ESG information from alternative sources to expand much faster than companies' voluntary disclosure.

In addition to rating agencies, there are also specialized ESG data providers that have grasped this trend.

Since there is no unified international or industry standard for ESG rating, the evaluation methods, ESG factors and coverage of rating agencies are different, and the ESG rating scores of the same enterprise are likely to vary greatly. Therefore, institutional investors, asset management companies, etc. also use the information of ESG data providers as an important reference and supplementary source of ESG information in the market in addition to rating agencies.

It is foreseeable that with further development of China's ESG market and continuous demand for ESG information from domestic and foreign investors, ESG data providers will also usher in a new round of development, and the ESG information collected and analyzed by these providers far exceeds the scope of ESG reports.

Undoubtedly, both rating agencies and data providers are accelerating the "multi-source" ecosystem for ESG information, which is obviously more conducive to verifying the quality of corporate ESG information in multiple dimensions and perspectives by information users.

At the same time, it also raises more urgent questions for companies, how to effectively enhance the transparency of ESG information and avoid changing from voluntary and active disclosure to passive?

03

Building disclosure matrix

Companies should diversify their ESG disclosure forms

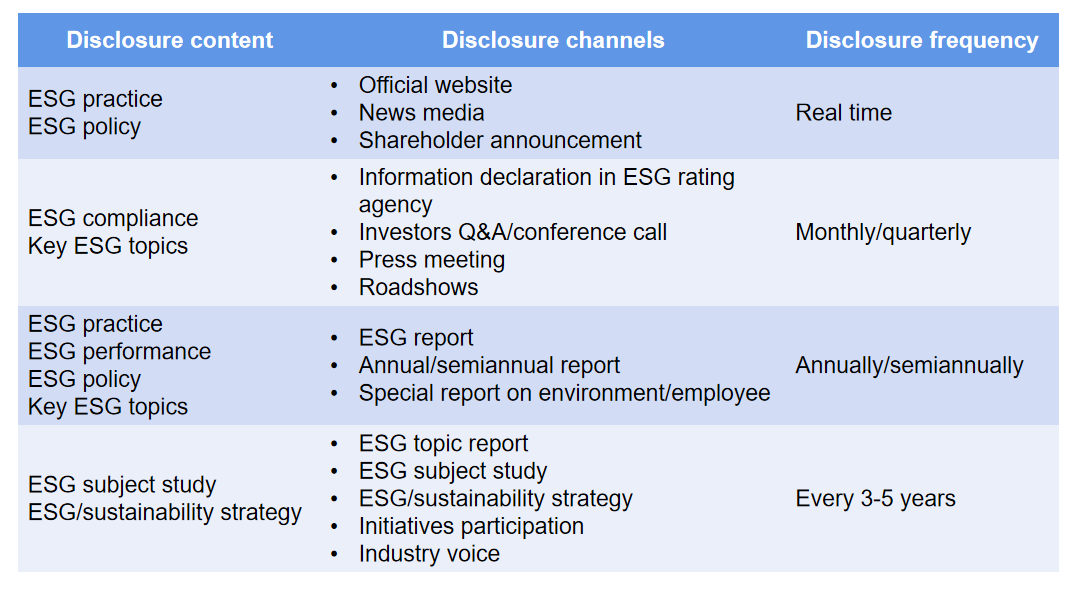

ESG disclosure should be based on and go beyond the ESG report. In this way, the regular disclosure can be complemented by the real-time information. And it achieves the combinations of short-term and long-term disclosure, special and comprehensive disclosure, and subjective disclosure and objective disclosure endorsed by stakeholders, so as to accurately and effectively transmit valuable ESG information to investors.

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号