The implications of Nasdaq diversity rules for listed companies

2021-12-10GoldenBeeGoldenBee0

In December 2020, Nasdaq submitted a proposal with the U.S. Securities and Exchange Commission (SEC) that would create diversity requirements in terms of gender expression, race or sexual orientation. The proposal has stirred up polarization in the United States and the international community.

The proposal has been approved on August 6, 2021 by SEC, which means that boardrooms would be required to have at least two “diverse” board members, and publicly disclose board-level diversity statistics on an annual basis.

As a popular exchange for Chinese companies to list overseas, Nasdaq's listing rules deserve the high attention, and there is clearly a huge difference between the "diversity" in the two countries’ contexts. So how should Chinese companies that are already Nasdaq-listed or interested in the IPO understand and implement the board diversity? How should they deal with the relevant indicators and even the overall disclosure requirements of ESG?

1. Nasdaq has long been concerned about "diversity"

Nasdaq gives a clear definition on “diverse board” that board members should have at least one woman (self-identified) and at least one from an underrepresented community, or someone who identifies as LGBTQ+. In other words, the core is around the two dimensions of racial diversity and gender/sexual diversity. The former is easy to understand given the national conditions of the United States, while the latter arouses controversy and also becomes Chinese companies’ concern. But in fact, Nasdaq has long focused on "diversity" and "gender equality".

In 2017, Nasdaq’s Nordic and Baltic exchanges launched the first ESG Reporting Guide, setting up the "S12. Board Diversity" indicator in social part. The indicator looks at the proportion of independent directors and women on boards in accordance with standards of international organizations, such as Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB). In 2019, Nasdaq issued ESG Reporting Guide 2.0, extending the scope of regulation to all companies listed. In the new guide, "board diversity" has been reclassified into governance (G1), focusing on women's share of boards and committees. It is worth noting that ESG Reporting Guide 2.0 provides a more detailed description of the design logic of indicators, one of the key points being the emphasis on the four goals among the Sustainable Development Goals (SDGs), of which "SDG5 Gender Equality" is listed. In June 2021, Nasdaq announced the launch of the ESG Data Hub, with seven data themes presented including "gender equality", showing the commitment to action on this theme.

The proposal has been approved on August 6, 2021 by SEC, which means that boardrooms would be required to have at least two “diverse” board members, and publicly disclose board-level diversity statistics on an annual basis.

As a popular exchange for Chinese companies to list overseas, Nasdaq's listing rules deserve the high attention, and there is clearly a huge difference between the "diversity" in the two countries’ contexts. So how should Chinese companies that are already Nasdaq-listed or interested in the IPO understand and implement the board diversity? How should they deal with the relevant indicators and even the overall disclosure requirements of ESG?

1. Nasdaq has long been concerned about "diversity"

Nasdaq gives a clear definition on “diverse board” that board members should have at least one woman (self-identified) and at least one from an underrepresented community, or someone who identifies as LGBTQ+. In other words, the core is around the two dimensions of racial diversity and gender/sexual diversity. The former is easy to understand given the national conditions of the United States, while the latter arouses controversy and also becomes Chinese companies’ concern. But in fact, Nasdaq has long focused on "diversity" and "gender equality".

In 2017, Nasdaq’s Nordic and Baltic exchanges launched the first ESG Reporting Guide, setting up the "S12. Board Diversity" indicator in social part. The indicator looks at the proportion of independent directors and women on boards in accordance with standards of international organizations, such as Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB). In 2019, Nasdaq issued ESG Reporting Guide 2.0, extending the scope of regulation to all companies listed. In the new guide, "board diversity" has been reclassified into governance (G1), focusing on women's share of boards and committees. It is worth noting that ESG Reporting Guide 2.0 provides a more detailed description of the design logic of indicators, one of the key points being the emphasis on the four goals among the Sustainable Development Goals (SDGs), of which "SDG5 Gender Equality" is listed. In June 2021, Nasdaq announced the launch of the ESG Data Hub, with seven data themes presented including "gender equality", showing the commitment to action on this theme.

Four SDGs focused by Nasdaq ESG Reporting Guide 2.0

Based on the information above, it is not difficult to understand the origin and logic of the "board diversity" proposal.

2. Effective response: Nasdaq provides practices and disclosure solutions for "board diversity"

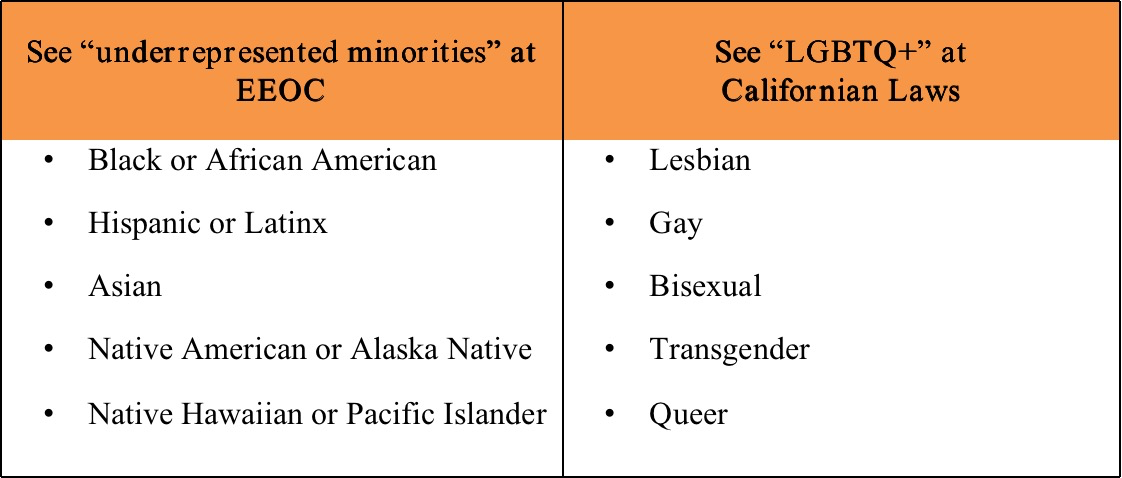

The purpose of regulating ESG disclosure is by no means simply asking companies to produce reports, but to trace, regulate, and promote effective management and efficient practices in relevant areas. Nasdaq has also taken this into account in its "Board Diversity" proposal, giving detailed implementation paths and flexible reporting tools. First, for companies registered in the United States, the exact definition of the "underrepresented minorities" and "LGBTQ+" can be referred to relevant classification of the Equal Employment Opportunity Commission (EEOC) and Californian Laws, respectively.

2. Effective response: Nasdaq provides practices and disclosure solutions for "board diversity"

The purpose of regulating ESG disclosure is by no means simply asking companies to produce reports, but to trace, regulate, and promote effective management and efficient practices in relevant areas. Nasdaq has also taken this into account in its "Board Diversity" proposal, giving detailed implementation paths and flexible reporting tools. First, for companies registered in the United States, the exact definition of the "underrepresented minorities" and "LGBTQ+" can be referred to relevant classification of the Equal Employment Opportunity Commission (EEOC) and Californian Laws, respectively.

Nasdaq's definition of "diversified board"

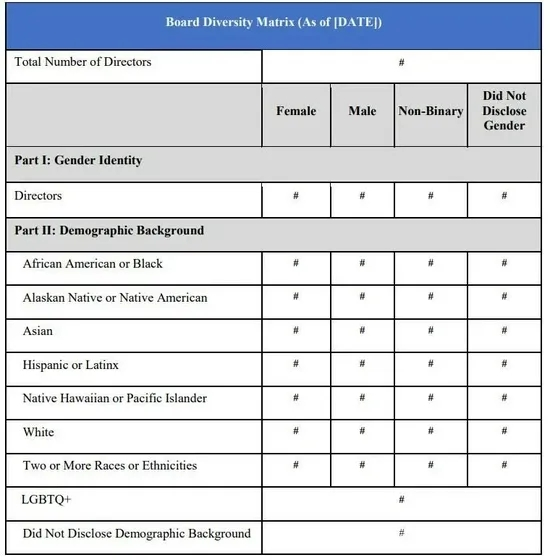

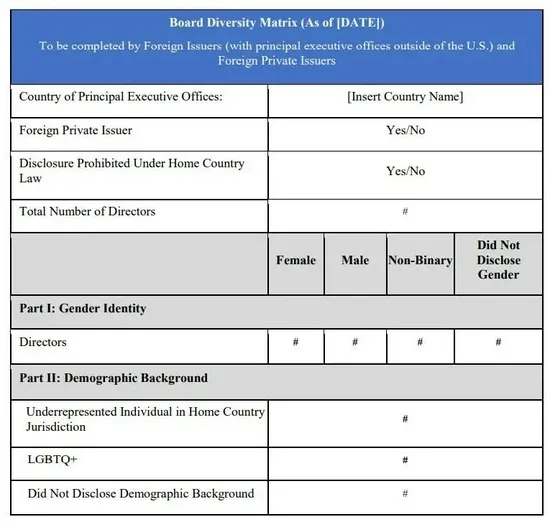

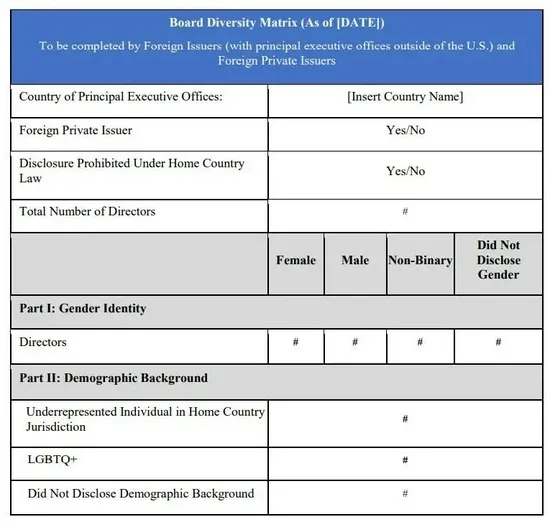

For small companies and foreign issuers, including the majority of Chinese companies that are listed on Nasdaq or interested in an IPO on Nasdaq, there are two options: whether to appoint two female directors at the same time, or to follow the same requirements as companies registered in the United States, but "from underrepresented minorities" can be depended on the laws and regulations of the country, considering the broader dimensions of, for example, country, ethnicity, culture, religion, language, etc. For companies with five or fewer board members, the appointment of one diversified director will meet the rules. Second, on the practical level, the first diversified director should be appointed by August 7, 2023, and the second can be flexibly adjusted to the market level in which the company is located. Nasdaq Global Select Market (NGS) and Nasdaq Global Markets (NGM) companies should complete their appointments by August 6, 2025, and Nasdaq Capital Markets (NCM) companies should complete their appointments by August 6, 2026. Newly listed companies are required to meet disclosure requirements one year after listing. Companies that fail to meet diversity targets are in need of an explanation. Third, in terms of disclosure, Nasdaq provides two versions of the "Board Diversity Matrix" templates, which applies to registered companies in the US as well as foreign issuers, and companies can choose their own version to fill in.

Board Diversity Matrix (for companies registered in the United States)

Board Diversity Matrix (for foreign issuers)

3. Difficulties among easiness: to meet stricter regulations on "climate change" and other issues

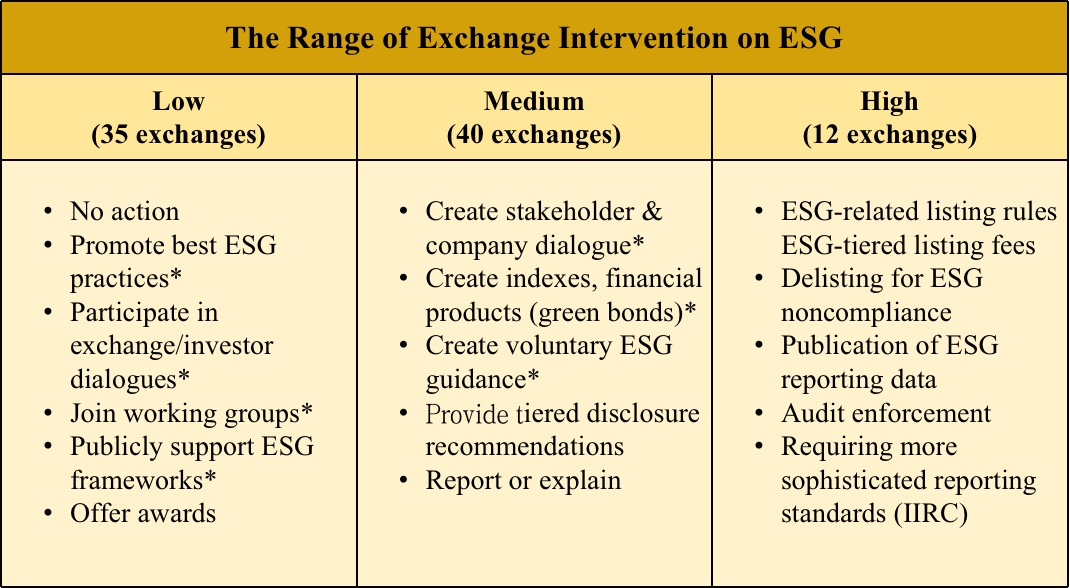

Generally speaking, ESG regulatory requirements from the Nasdaq exchange are relatively flexible and loose. In the ESG Reporting Guide 2.0, Nasdaq provides an analysis on the range of exchange intervention on ESG. Based on regulatory means and measures, Nasdaq classifies the intervention into "high/medium/low" three categories. Nasdaq's regulatory approaches, including index development, financial products, and promotion of best ESG practices, all fall in the "medium/low" range.

*Nasdaq actions to date (source: Nasdaq’s ESG Reporting Guide 2.0)

In terms of ESG disclosure alone, Nasdaq has not yet made additional requirements for IPO applicants. Considering that the ESG report is only part of the “total mix” of the investor’s assessment of the target company, the ESG Reporting Guide 2.0 is positioned as a completely voluntary initiative. Even if the "disclose or explain" requirement is put forward in the new "board diversity" rule, the materiality of the company's explanation will not be assessed. However, for Chinese companies that are already Nasdaq-listed or interested in Nasdaq IPO, challenges remain. In February 2021, public input on climate change disclosure is requested by the US Securities and Exchange Commission (SEC). The SEC new chair Gary Gensler also said, “climate-related disclosure is a top priority." Once the proposal is passed, all US-listed companies will be required to compulsorily disclose such information. "SDG13 Climate Action" is also one of ESG disclosure topics that Nasdaq concerns. As for adjustment efforts, will climate change-related information become Nasdaq's next "board diversity proposal"? In the context of accelerating global attention to ESG and its regulation, will Nasdaq put forward more refined requirements for ESG disclosure? Stay tuned to see what will happen next.

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号