Natural capital: a new way of evaluating nature's true value

2019-09-07GoldenBeeadmin0010

Interviewee|Mark Gough, CEO and Executive Director of Natural Capital Coalition

Studies from the Global Footprint Network show that July 29 is the 2019 Earth Overshoot Day, and the natural resources currently used by human beings are 1.75 times as much as the renewable resources of the Earth’s ecosystem. In other words, human has been using 1.75 Earth. This means that the speed of human exploitation of natural resources is accelerating, and human beings are further endangering the Earth’s future ability to regenerate and recover. It can be said that the increase of human financial capital is largely realized at the cost of the use, development and degradation of natural and social capital. Therefore, the incorporation of the concept of natural capital in decision-making is essential for the protection of the world’s nature.

China Sustainability Tribune invited Mark Gough, CEO and Executive Director of Natural Capital Coalition (NCC), to lead us to understand the development of natural capital and provide some tools and guidance on how enterprises should understand the relationship between natural capital and biodiversity and ecosystem services, and how to identify, evaluate and calculate natural capital. It is hoped that it can help enterprises to take natural capital into consideration in decision-making, so as to maintain the integrity of nature and enhance the competitiveness of enterprises.

China Sustainability Tribune invited Mark Gough, CEO and Executive Director of Natural Capital Coalition (NCC), to lead us to understand the development of natural capital and provide some tools and guidance on how enterprises should understand the relationship between natural capital and biodiversity and ecosystem services, and how to identify, evaluate and calculate natural capital. It is hoped that it can help enterprises to take natural capital into consideration in decision-making, so as to maintain the integrity of nature and enhance the competitiveness of enterprises.

China Sustainability Tribune: When did you become interested in the study of natural capital? Why do you think the study and promotion of natural capital is significant?

Mark: During my time working as the Head of Sustainability for the Crown Estate, it became clear to me that taking account of the financial value of the Crown’s holdings alone was failing to capture the full value that flowed from them.

As well as a substantial commercial portfolio, The Crown Estate is also responsible for more than half of the foreshore of the United Kingdom, virtually all of the Kingdom’s territorial seabed, and much agricultural land and woodland. We felt that much of the value provided by these natural holdings was not represented on our balance sheets or in our reporting. For instance, the value provided by the many ecosystem services such as carbon sequestration, crop pollination, air filtration, soil fertility and biodiversity habitat among numerous others.

A natural capital approach allows us to identify, measure and value these benefits, and to put them at the heart of decision making alongside financial capital.

China Sustainability Tribune: Natural capital means treating nature as a kind of capital, and it calls on us to protect environment through a business perspective. So, how do you systematically think about the meaning of business, business principles and nature? What are the internal logic and core points of natural capital?

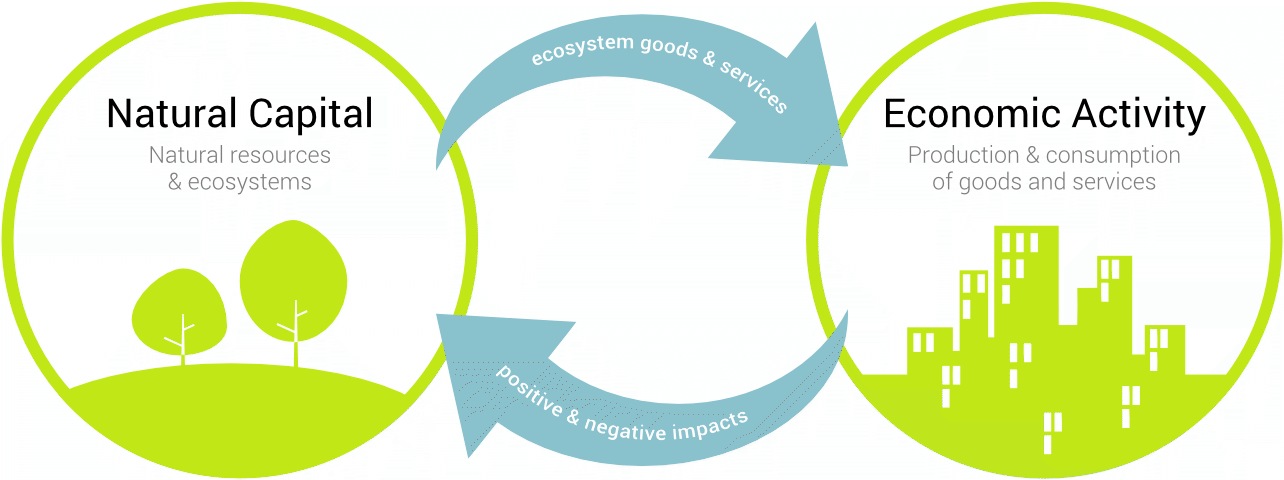

Mark: All businesses are dependent to varying degrees on nature. Businesses also impact on the health of the natural world. In many cases, businesses are negatively impacting on the health of ecosystems that they depend on to remain successful. Therefore, these relationships with nature must be at the very core of business models and decision making if organizations want to truly understand their business, their risks and opportunities, and their ability to identify opportunities for efficiency, resilience and innovation.

By framing nature in terms of a stock of capital which delivers a flow of benefits or ‘ecosystem services’, organizations can bring their relationship with nature into existing processes, strategy and analysis, rather than bolting on sustainability initiatives that are significantly less likely to influence key decisions by senior managers.

Many organizations have a policy on water, another on energy, another on biodiversity, another on forests – the list goes on. Often the people working in these areas don’t talk to one another; in some cases, they are actually in competition for budget allocation. A policy on one of these areas, without an understanding of how it connects with the others, means we’re often playing a four-dimensional game of tug of war, attempting to keep interconnected systems in balance without understanding the ways in which they work and connect.

Rather than separating nature into different parts, to be addressed by different teams with unaligned strategies, a natural capital approach encourages organizations to integrate these different considerations into centralized core strategy and decision making.

Mark: During my time working as the Head of Sustainability for the Crown Estate, it became clear to me that taking account of the financial value of the Crown’s holdings alone was failing to capture the full value that flowed from them.

As well as a substantial commercial portfolio, The Crown Estate is also responsible for more than half of the foreshore of the United Kingdom, virtually all of the Kingdom’s territorial seabed, and much agricultural land and woodland. We felt that much of the value provided by these natural holdings was not represented on our balance sheets or in our reporting. For instance, the value provided by the many ecosystem services such as carbon sequestration, crop pollination, air filtration, soil fertility and biodiversity habitat among numerous others.

A natural capital approach allows us to identify, measure and value these benefits, and to put them at the heart of decision making alongside financial capital.

China Sustainability Tribune: Natural capital means treating nature as a kind of capital, and it calls on us to protect environment through a business perspective. So, how do you systematically think about the meaning of business, business principles and nature? What are the internal logic and core points of natural capital?

Mark: All businesses are dependent to varying degrees on nature. Businesses also impact on the health of the natural world. In many cases, businesses are negatively impacting on the health of ecosystems that they depend on to remain successful. Therefore, these relationships with nature must be at the very core of business models and decision making if organizations want to truly understand their business, their risks and opportunities, and their ability to identify opportunities for efficiency, resilience and innovation.

By framing nature in terms of a stock of capital which delivers a flow of benefits or ‘ecosystem services’, organizations can bring their relationship with nature into existing processes, strategy and analysis, rather than bolting on sustainability initiatives that are significantly less likely to influence key decisions by senior managers.

Many organizations have a policy on water, another on energy, another on biodiversity, another on forests – the list goes on. Often the people working in these areas don’t talk to one another; in some cases, they are actually in competition for budget allocation. A policy on one of these areas, without an understanding of how it connects with the others, means we’re often playing a four-dimensional game of tug of war, attempting to keep interconnected systems in balance without understanding the ways in which they work and connect.

Rather than separating nature into different parts, to be addressed by different teams with unaligned strategies, a natural capital approach encourages organizations to integrate these different considerations into centralized core strategy and decision making.

China Sustainability Tribune: What challenges has natural capital faced and what progress has it made since it put forward? As for as you know, what is the development status of natural capital in the world?

Mark: Natural capital as a concept has faced some challenges. Firstly, there is a perception that it is technical and complex, and that it is challenging to get exact numbers from a natural capital assessment. While it’s true that conducting an assessment can be technical, the Natural Capital Protocol, developed by the Natural Capital Coalition, provides an internationally standardized decision-making framework to simplify this process and to guide practitioners through the process of conducting an assessment. As natural capital becomes more established in organizations around the world, there are also now a wealth of professional services that can help organizations to conduct an assessment, and we’re seeing a large increase in the amount of assessments being undertaken in both the public and private sectors.

Natural capital approaches have also faced criticism from people who muddle the concepts of ‘price’ and ‘value’, and who believe that a natural capital approach ‘commodifies’ nature. Advocates of natural capital are sometimes accused of ‘putting a price on nature’ or ‘pricing the priceless’, but in fact our core assertion is that prices have failed to reflect the true value of the natural world, and that the economic systems that we are using are broken.

A natural capital approach works to illuminate nature’s (often hidden) value, whether it be economic, social, environmental, cultural or spiritual value, and whether this value is expressed in qualitative or quantitative (including economic) terms.

A natural capital approach, far from abetting this neoliberal model, turns it on its head. While there are many prices for the products that are created with nature and natural derivatives, the value of leaving the natural world intact is often far less understood, or worse regarded as 0 Natural capital approaches work to illuminate the value of an intact natural world, by recognizing the value created in the absence of traditional economic activities.

Mark: Natural capital as a concept has faced some challenges. Firstly, there is a perception that it is technical and complex, and that it is challenging to get exact numbers from a natural capital assessment. While it’s true that conducting an assessment can be technical, the Natural Capital Protocol, developed by the Natural Capital Coalition, provides an internationally standardized decision-making framework to simplify this process and to guide practitioners through the process of conducting an assessment. As natural capital becomes more established in organizations around the world, there are also now a wealth of professional services that can help organizations to conduct an assessment, and we’re seeing a large increase in the amount of assessments being undertaken in both the public and private sectors.

Natural capital approaches have also faced criticism from people who muddle the concepts of ‘price’ and ‘value’, and who believe that a natural capital approach ‘commodifies’ nature. Advocates of natural capital are sometimes accused of ‘putting a price on nature’ or ‘pricing the priceless’, but in fact our core assertion is that prices have failed to reflect the true value of the natural world, and that the economic systems that we are using are broken.

A natural capital approach works to illuminate nature’s (often hidden) value, whether it be economic, social, environmental, cultural or spiritual value, and whether this value is expressed in qualitative or quantitative (including economic) terms.

A natural capital approach, far from abetting this neoliberal model, turns it on its head. While there are many prices for the products that are created with nature and natural derivatives, the value of leaving the natural world intact is often far less understood, or worse regarded as 0 Natural capital approaches work to illuminate the value of an intact natural world, by recognizing the value created in the absence of traditional economic activities.

China Sustainability Tribune: What challenges will enterprises face when integrating natural capital into every business decision making process? How should enterprises promote their awareness and capability when they transforming from traditional business model? What tools and processes can be used to help enterprises manage natural capital?

Mark: We see that there is often a skills gap when organizations look to do this sort of work for the first time. Usually consultants will be hired in to do parts of the work, and this can incur a cost that is more challenging for small and medium sized businesses.

One of the strengths however, is that natural capital approaches are not bolt-ons, they are designed to be incorporated into existing business models and decision-making processes, and so once organizations develop the capabilities to conduct and analyze natural capital assessments, they can make decisions based on this information in the same way they make decisions relating to their financial capital.

There are a multitude of different tools that organizations can use, depending on what impact and/or dependencies they are looking to understand. The Natural Capital Protocol however, developed by the Natural Capital Coalition and released in 2016, harmonizes this complex space, and provides an internationally accepted decision-making framework that can be used at a project, product or organizational level, and by organizations of all sizes, and based in all geographies. The many tools and methodologies that can be used can all be applied with the Protocol’s framework. Many of the consultancies in this space will be following the steps and stages of the Natural Capital Protocol, no matter what tools they decide are most relevant in the given context.

Mark: We see that there is often a skills gap when organizations look to do this sort of work for the first time. Usually consultants will be hired in to do parts of the work, and this can incur a cost that is more challenging for small and medium sized businesses.

One of the strengths however, is that natural capital approaches are not bolt-ons, they are designed to be incorporated into existing business models and decision-making processes, and so once organizations develop the capabilities to conduct and analyze natural capital assessments, they can make decisions based on this information in the same way they make decisions relating to their financial capital.

There are a multitude of different tools that organizations can use, depending on what impact and/or dependencies they are looking to understand. The Natural Capital Protocol however, developed by the Natural Capital Coalition and released in 2016, harmonizes this complex space, and provides an internationally accepted decision-making framework that can be used at a project, product or organizational level, and by organizations of all sizes, and based in all geographies. The many tools and methodologies that can be used can all be applied with the Protocol’s framework. Many of the consultancies in this space will be following the steps and stages of the Natural Capital Protocol, no matter what tools they decide are most relevant in the given context.

(The cover of Natural Capital Protocal)

China Sustainability Tribune: The mainstreaming of natural capital in the business community cannot be promoted without the support of capital markets, government and consumers. What actions and efforts do you think these stakeholders should take?

Mark: Governments and capital markets have large roles to play. Governments have a key role in creating the enabling approach for natural capital thinking to thrive. For instance:

1. Promote policy coherence across different sectors and areas to harness synergies and reduce trade-offs for natural capital.

2. Scale up the suite of policy instruments for natural capital approaches and get the economic incentives right to ensure nature is better reflected in producer and consumer decision-making.

3. Establish consistent and comparable finance tracking and reporting frameworks across countries and companies.

4. Identify, assess and reform subsidies harmful to natural capital at the national level, and expand internationally comparable information on those subsidies, for example, through peer review.

5. Assess and communicate socio-economic dependencies and impacts on natural capital at relevant geographic scales.

6. Establishing specific, measurable and (to the greatest extent possible) quantitative targets for the post-2020 framework is essential to improving the ability to monitor progress. More specific and measurable targets can enhance clarity on the actions needed by government, the private sector and civil society, and would improve the ability to monitor progress. Targets and their associated indicators need to be developed synergistically and iteratively, to ensure stronger linkages between the two.

Capital markets have large sway in influencing the practices of businesses. They may decide for example to implement minimum standards for companies they finance, invest in or insure. In the same way that you must install a fire alarm in order to qualify for fire insurance, or must report on financial performance to potential investors, similar common-sense minimum standards could be put in place to understand a business’s impacts and dependencies on natural capital, and what risks and opportunities may be present based on an analysis of these relationships.

Financial institutions may also seek blended finance solutions, where private sector capital is combined with public sector investment or civil society/philanthropist capital in order to deliver projects that include social and natural, as well as financial returns.

China Sustainability Tribune: How should we understand the relationship between natural capital and sustainable development? What is the significance of “natural capital” to the UN 2030 Sustainable Development Goals (SDGs)?

Mark: Natural capital approaches operate under the same fundamental insight as the SDGs: environmental, social, human and economic issues are fundamentally connected, and must be addressed together. In this way, natural capital provides a critical tool to delivering the SDGs and measuring our progress against the milestones of the goals.

A natural capital approach also allows us to identify solutions that deliver value against environmental, social and economic areas. For instance, a natural capital assessment may identify a nature-based solution, where, for example, the restoration of a landscape is more cost effective than building an expensive water plant. As well as delivering economic benefits, this work delivers obvious environmental benefits and the restoration work creates jobs, and creates areas for recreation and potential recreation-based business opportunities.

(Images in this article are from the internet)

Mark: Governments and capital markets have large roles to play. Governments have a key role in creating the enabling approach for natural capital thinking to thrive. For instance:

1. Promote policy coherence across different sectors and areas to harness synergies and reduce trade-offs for natural capital.

2. Scale up the suite of policy instruments for natural capital approaches and get the economic incentives right to ensure nature is better reflected in producer and consumer decision-making.

3. Establish consistent and comparable finance tracking and reporting frameworks across countries and companies.

4. Identify, assess and reform subsidies harmful to natural capital at the national level, and expand internationally comparable information on those subsidies, for example, through peer review.

5. Assess and communicate socio-economic dependencies and impacts on natural capital at relevant geographic scales.

6. Establishing specific, measurable and (to the greatest extent possible) quantitative targets for the post-2020 framework is essential to improving the ability to monitor progress. More specific and measurable targets can enhance clarity on the actions needed by government, the private sector and civil society, and would improve the ability to monitor progress. Targets and their associated indicators need to be developed synergistically and iteratively, to ensure stronger linkages between the two.

Capital markets have large sway in influencing the practices of businesses. They may decide for example to implement minimum standards for companies they finance, invest in or insure. In the same way that you must install a fire alarm in order to qualify for fire insurance, or must report on financial performance to potential investors, similar common-sense minimum standards could be put in place to understand a business’s impacts and dependencies on natural capital, and what risks and opportunities may be present based on an analysis of these relationships.

Financial institutions may also seek blended finance solutions, where private sector capital is combined with public sector investment or civil society/philanthropist capital in order to deliver projects that include social and natural, as well as financial returns.

China Sustainability Tribune: How should we understand the relationship between natural capital and sustainable development? What is the significance of “natural capital” to the UN 2030 Sustainable Development Goals (SDGs)?

Mark: Natural capital approaches operate under the same fundamental insight as the SDGs: environmental, social, human and economic issues are fundamentally connected, and must be addressed together. In this way, natural capital provides a critical tool to delivering the SDGs and measuring our progress against the milestones of the goals.

A natural capital approach also allows us to identify solutions that deliver value against environmental, social and economic areas. For instance, a natural capital assessment may identify a nature-based solution, where, for example, the restoration of a landscape is more cost effective than building an expensive water plant. As well as delivering economic benefits, this work delivers obvious environmental benefits and the restoration work creates jobs, and creates areas for recreation and potential recreation-based business opportunities.

(Images in this article are from the internet)

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号