TNFD framework released for corporate biodiversity management

2023-11-01GoldenBeeGoldenBee0

We live in a complex and interconnected global ecosystem, dependent on and influencing nature. In recent years, one of the reasons for the emergence of problems such as climate change and the biodiversity crisis is that our economic system has failed to consider the value of nature and biodiversity when making decisions, and many companies do not understand how their activities positively or negatively affect nature, or how changes in the natural environment will affect their medium- and long-term strategic and financial planning.

In December 2022, the 15th Conference of the Parties (COP15) to the Convention on Biological Diversity adopted the Kunming-Montreal Global Biodiversity Framework, which specifies 4 goals for 2050 and 23 targets for 2030, of which target 15 "Businesses assess and disclose biodiversity dependencies, impacts and risks, and reduce negative impacts" has become an important basis for decision makers, large multinational companies and financial institutions to improve their biodiversity management.

On September 18, 2023, the Recommendations of the Taskforce on Nature-related Financial Disclosures (V1.0) was officially released, providing companies with a framework standard and roadmap for nature-related risk management and disclosure, which enables financial institutions and companies to integrate nature-related risks and opportunities into their decision-making mechanisms.

Get Recommendations of the Taskforce on Nature-related Financial Disclosures:

https://tnfd.global/publication/recommendations-of-the-taskforce-on-nature-related-financial-disclosures/

What is TNFD?

The Taskforce on Nature-related Financial Disclosures (TNFD) is a new global platform to cope with the continuous deterioration of natural ecosystems, jointly launched by the United Nations Development Programme (UNDP), the United Nations Environment Programme Finance Initiative (UNEP FI), the World Wide Fund for Nature (WWF) and the non-governmental organization Global Canopy. Building on the successful experience of the Taskforce on Climate-related Financial Disclosures (TCFD), a working group composed of senior executives from leading international financial institutions, corporations and market service companies jointly developed TNFD framework recommendations aimed at promoting the co-development of global capital and nature and mitigating the negative impact of economic activities on nature, ultimately supporting the shift in global financial flows from nature-negative to nature-positive outcomes.

TNFD framework composition

The TNFD framework contains a set of guidance documents designed by and for the market, providing users with scientific and reliable risk assessment and disclosure methods. This set of documents covers two main parts.

TNFD Disclosure Recommendations

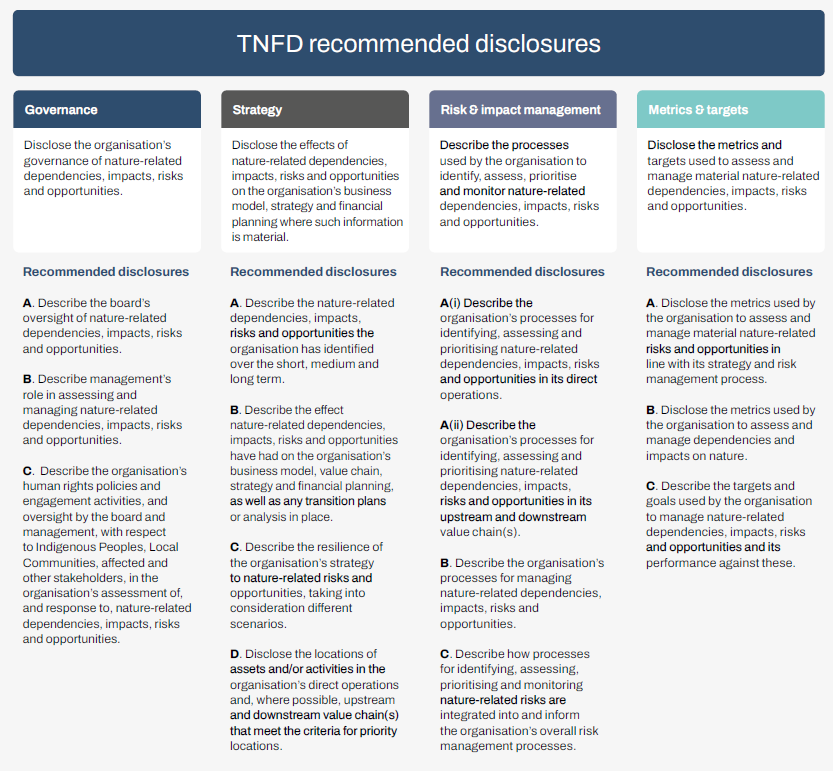

• The four disclosure pillars, including governance, strategy, risk and impact management, metrics and targets, continue the TCFD framework and are aligned with the IFRS S1 standard.

• 14 recommended disclosures, aligned with TCFD’s 11 recommendations, to encourage and support the integration of climate and nature-related risk and opportunity management and disclosure, giving companies and financial institutions a complete understanding of their environmental risks.

• The TNFD framework adds three disclosures to the TCFD, incorporating the concept of "nature-related dependencies, impacts, risks and opportunities", consistent with the requirement of Target 15 of the Kunming-Montreal Global Biodiversity Framework to "assess and disclose biodiversity dependencies, impacts and risks, and reduce negative impacts".

TNFD recommended disclosures

Additional guidance

Disclosing important nature-related issues in mainstream corporate reporting requires knowledge and ability to identify and evaluate nature-related issues in corporate activities. To address these capacity building needs and support voluntary adoption of TNFD recommendations, TNFD has developed a set of additional disclosure guidance and plans to publish key industry guidance to help companies identify, assess, manage and disclose their nature-related dependencies, impacts, risks and opportunities. These additional disclosure guidance are not mandatory for organizations wishing to report under the TNFD disclosure recommendations, but merely provide guidance. TNFD uses a pyramid to illustrate the different additional disclosure guidance and their relationships, with TNFD disclosure recommendations at the top and a set of guidance documents (as shown in the figure below) below it, including:

• Getting started with TNFD

• Identifying and assessing nature-related issues: The LEAP approach

• Sector guidance

• Biome guidance

• Scenario analysis

• Target setting

• Engagement with Indigenous Peoples, Local Communities and affected stakeholders

TNFD recommendations and additional guidance

Integrating diverse experiences

Based on the wealth of information, tools, frameworks, and methodologies that many other groups and organizations have developed today, TNFD attempts to leverage and bring together the proven experience of existing standard-setting organizations and integrate them into an integrated, end-to-end risk and opportunity assessment process. For example, TNFD disclosure recommendations are aligned with standards such as the Global Biodiversity Framework, the EU regulation Corporate Sustainability Reporting Directive (CSRD), IFRS S1, and the GRI.

TNFD and current nature-related standards development organizations

As early as 2022, TNFD, together with leading institutions such as the Capitals Coalition, the Business for Nature (BfN), the Science Based Targets Network (SBTN), the World Business Council for Sustainable Development (WBCSD), the World Economic Forum (WEF) and the World Wide Fund for Nature (WWF), developed the "High-Level Business Action on Nature". The framework offers an overview of key actions companies can take to help reverse nature loss and contribute to a nature positive world under the headings of Assess, Commit, Transform, and Disclose (ACT-D). By implementing these key actions, companies can demonstrate that they are making a meaningful contribution to reversing the destruction of nature and helping to build a fair, net-zero, nature-positive future.

In 2023, the Capitals China Hub (established by the Capitals Coalition and GoldenBee Consulting) launched the ACT-D Biodiversity Management Case Collection of Chinese Enterprises, and the relevant results are scheduled to be officially released at the COP16 in Turkey in December 2024.

Capitals China Hub

Founded in July 2022 by the Capitals Coalition and GoldenBee Consulting, Capitals China Hub is committed to promoting the mainstreaming of industrial and commercial biodiversity management and incubating biodiversity business solutions in China.

Enterprises interested in participating in the ACT-D Biodiversity Management Case Collection can contact us through: Ms. Yang Shihui (shihui.yang@goldenbeechina.com).

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号