How do Chinese companies respond to the latest ISSB Standards?

2023-07-19未知责任编辑0

On June 8-9, 2023, at the 18th International CSR Forum with the theme of "Responsible Competitiveness in the Chinese Path to Modernization", Leng Bing, Member of International Sustainability Standards Board (ISSB), delivered a keynote speech on "Challenges and Impacts of ISSB Standards for Sustainability-related Management Practices and Information Disclosure of Chinese Enterprises". In his speech, he shared the latest progress of ISSB standards with domestic enterprises and other stakeholders, which was followed by suggestions for Chinese enterprises to respond to these changes. The following are the main contents of his speech.

I am very pleased to take this opportunity to share the latest progress of ISSB with domestic companies and other stakeholders.

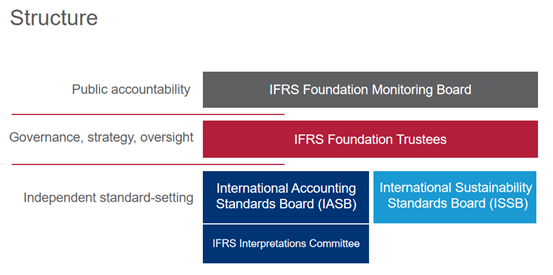

ISSB is a parallel body to the International Accounting Standards Board (IASB), co-headed by the International Financial Reporting Standards (IFRS) Foundation. IFRS has three functions: fundraising for the ISSB, selection of the Board, and overseeing the implementation of the compliance process. The two Boards are independent standard-setting bodies responsible for the development of International Accounting Standards and IFRS sustainable disclosure standards, respectively. The picture below is the IFRS Foundation's three-tier structure.

Why is ISSB established?

We have seen that global standards, frameworks and recommendations for both sustainability and ESG are emerging, which brings considerable challenges in the implementation. Therefore, it becomes a global consensus to establish a global baseline of high-quality sustainability-related disclosure standards.

Moreover, non-financial information, especially sustainability factors, has become the mainstream of investment decisions. Facing this trend, the establishment of a separate set of disclosure standards for sustainability information reporting within the scope of general financial reporting could provide better solutions to special decisions, as this part of information may not be fully reflected in the financial statements in accordance with accounting standards and conventions.

Furthermore, governments around the world also support the establishment of a global baseline for sustainability disclosure in capital markets.

What is the goal of ISSB?

The goal of ISSB is to deliver a global baseline of sustainability-related disclosures which requires to have the following basic characteristics:

1. Decision-useful

The standards should provide investors with information that is as reliable as financial statements in the decision-making process, as investors' decisions shape the pricing of companies in the capital markets.

ISSB's goal in this area is to develop a global baseline of sustainability-related disclosures that meet the needs of global investment decision makers.

2. Cost-effective

It is efficient for the preparer rather than a burden.

ISSB is designed to help companies develop a comprehensive system of sustainability-related disclosures that is useful for decision making. This is not an ESG rating, but rather the company's disclosure on its responsibility, like its own financial statements, for which it is accountable.

3. Market-informed

A rigorous and transparent due process for decision making should be ensured.

ISSB delivers a common language of sustainability-related disclosures worldwide, with the flexibility for regional ‘building blocks’ to be added by regulators when necessary to meet local and multi-stakeholder information needs.

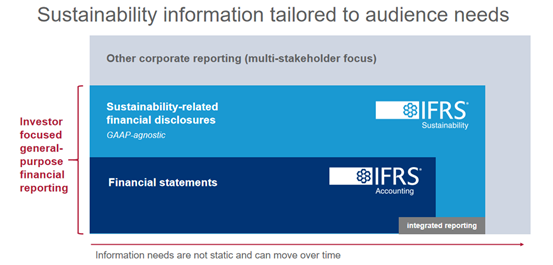

The picture below summarizes the blueprint of IFRS.

The dark blue section is the financial statements prepared in line with accounting standards, and the light blue section is the sustainability report prepared complying with the sustainability reporting standards, which are combined to form the general-purpose financial reporting.

The gray circle, other corporate reporting (multi-stakeholder focus), includes broader issues other than the general-purpose financial reporting to serve a broader range of stakeholders beyond investors.

ISSB reference standards

The development of ISSB standards builds on investor-focused standards and frameworks such as Integrated Reporting, Sustainability Accounting Standards Board (SASB) Standards, Climate Disclosure Standards Board (CDSB) Framework, Task Force on Climate-related Financial Disclosures (TCFD).

TCFD is established by the Financial Stability Board (FSB) formed by G20 member states. It has been widely adopted globally since 2018, and is widely used in China under the strong promotion of the People's Bank of China.

Integrated Reporting and SASB Standards are the integrated reporting framework from the International Integrated Reporting Council (IIRC) and the SASB. The two parts were merged to form the Value Reporting Foundation (VRF), which was absorbed into the ISSB last August. CDSB has the same requirements of high-quality disclosure and is one of the references for the ISSB's work.

On November 23, 2021, ISSB was announced at the UN Climate Change Conference in Glasgow (COP26). At the end of January 2022, we released the exposure draft and received more than 1,400 feedbacks in total, followed by discussions in response to the comments which were done at the beginning of this year. The final draft will be released in the following weeks. The first batch of the final guidelines has two copies: General Requirements for Sustainability-related Disclosures (S1) and Climate-related Disclosures (S2).

S1: General Requirements for Sustainability-related Disclosures

1. S1 applies TCFD structure, including Strategy, Governance, Risk Management, and Metrics & Targets (four pillars), and extend it to all areas of sustainability risk, requiring disclosure of material information about risks and opportunities related to sustainability to meet the information needs of investors.

2. S1 requires industry-specific disclosures, which is different from accounting standards.

3. For items other than climate (S2), S1 refers to sources to help companies identify sustainability-related risks and opportunities and disclosures.

There is a need to identify what information is required to be disclosed about the relevant risk, and this information must be material to investors. Information "is material if omitting, misstating or obscuring that information could reasonably be expected to influence investor decisions".

4. S1 can be used by companies that report to any Generally Accepted Accounting Principles (GAAP).

S2: Climate-related Disclosures

3 points should be addressed:

1. Is Scope 3 of Greenhouse Gad (GHG) to be disclosed?

The most important point in S2 is that whether Scope 3 of the international emissions accounting tool Greenhouse Gas (GHG) Protocol must be disclosed. S2 explicitly requires that it must be disclosed, although companies can choose not to disclose it in the first year. ISSB has different timing for the implementation of the guidelines, considering country-specific adoption.

2. How are GHG emissions measured?

Currently, there is no unified measurement method worldwide. Many countries have adopted ISO 14061-1.

The ISSB standards state that if there are national policies or clear regulations in the exchange, then companies will calculate GHG emissions according to these regulations. If there are no relevant regulations, it is calculated according to ISO 14061-1 with one-year buffer period. For scope 3 measurement, it is best if companies have direct measurement methods. If it is difficult to obtain data along the value chain, companies can use other methods such as third-party collection to estimate.

3. Scenario analysis is mandatory.

Scenario analysis is a widely used method despite its complex definition. For relatively small companies, it is acceptable for them to use a qualitative and descriptive approach to conduct scenario analysis at the beginning stage.

For the next step, ISSB will publish guidelines or easy-to-understand materials for use.

The impact of latest ISSB standards on China

The latest ISSB standards are planned to be effective from January 1, 2024.

1. These latest ISSB standards are mandatory, closely linked with the country and regulation. On a global scale, voluntary adoption of these standards is acceptable, but the main way is mandatory and regulatory adoption.

It is likely that in the near future, many Chinese companies will follow the same sustainability-related disclosure standards as they do for preparing financial statements in accordance with accounting standards.

2. That whether China will adopt these standards or not depends on the domestic regulators and policy makers.

In the context of economic globalization, the relevant Chinese standards may be linked to the latest ISSB standards, either by direct adoption or by adjustments.

From the perspective of ISSB, we do not encourage the direct application of ISSB standards, but rather encourage the establishment of a unified sustainability-related disclosure standard and related institutions in the country, and then introduce and implement ISSB standards.

The key of ISSB's next step is to focus on the implementation of S1 and S2, for which we provide a set of implementation basics including classification criteria for digital reporting, capacity building, and consultation on regulation and adoption.

In addition, in line with our two-year work plan, we will do research on four more projects that are biodiversity, human capital, human rights and the integration between financial reporting and sustainability disclosure.

How do Chinese companies respond to the latest ISSB standards?

Our recommendations:

- Assess internal systems and processes for collecting, aggregating, and validating sustainability-related information across the company and its value chain;

- Consider sustainability-related risks and opportunities affecting the business;

- And review standards and supporting materials proposed by ISSB, including SASB standards, the CDSB framework, and TCFD recommendations.

In particular, we have two recommendations:

1. Sustainability management

Companies need to distinguish between sustainability risk management and sustainability risk disclosure. ISSB, as a standard-setting body, expects companies to focus their energy and resources exclusively on sustainability risk management.

For an emerging economy as large as China, one of the important lessons we have learned over the past decades of successive reforms is that often compliance management promotes the substantive management.

For example, over 20 years ago, accounting standards required the use of the real interest rate. However, in the actual application of risk management in banks, it has only been 10 years since the use of effective interest rate replaced the contract interest rate in the daily work. This is how the compliance management has fostered the process of substantive management, which takes time, patience and solid preparation.

2. Technically, we recommend companies to learn more about the relevant standards referred by ISSB.

For example, SASB has a total of 77 standards and 11 categories. On average each standard covers four or five industry topics, 14 disclosure indicators, counting only the first level indicators, and 70% of the 14 disclosure indicators are quantitative.

The quantitative standards are very popular and highly applicable by companies, and now are implemented by about 3,000 large companies worldwide.

This article is based on Leng Bing's speech at the 18th International CSR Forum.

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号