Yin Gefei invited to give speech at Nanjing ESG salon

2023-07-18GoldenBeeGoldenBee0

Yin Gefei, Founder and Chief Expert of GoldenBee Consulting, was invited to attend the salon to give a keynote speech on "ESG Investment and Development of Central State-owned Enterprises (SOEs) in the Chinese path to Modernization". In attendance, there were executives from nearly 30 SOEs and multinational corporations, including China National Building Material Group Co., Ltd. (CNBM), China General Nuclear Power Group (CGN), Power Construction Corporation of China (POWERCHINA), NIPSEA Group, Phoenix Contact (China), Merck, Royal Golden Eagle, etc., and representatives from international chambers of commers, and scholars from ESG industry.

In the first half of the salon, investment promotion activities for five green and low-carbon theme parks were held and seven cooperation projects on China's 30 60 Decarbonization Goal were signed. Besides, the Nanjing ESG Sustainable Investment Research Report was released, which shows that Nanjing is leading in the Yangtze River Delta region in terms of ESG score, with three dimensions, including environmental, social and governance advantages, ranking top.

Thereafter, Mr. Yin gave a keynote speech on "ESG Investment and Development of Central SOEs in the Chinese path to Modernization". The presentation is as follows:

1. ESG is highly compatible with the inherent requirements of Chinese path to modernization.

The report to the 20th National Congress of the Communist Party of China (CPC) pointed out that Chinese path to modernization is the modernization with a huge population, of common prosperity for all, of material and cultural-ethical advancement, of harmony between humanity and nature and of peaceful development. ESG is highly compatible with these five characteristics of Chinese path to modernization. Among them:

E addresses that the positive impact of natural and environmental factors should outweigh the negative ones. As the ESG competitiveness of enterprises continues to improve, their impact on nature and the environment should also continue to be positive, contributing to a Chinese path of modernization of harmony between humanity and nature.

S is, to a certain extent, to manage the relationship and responsibilities with the interests of employees, supply chain partners and communities, reflecting the balanced and effective contribution of enterprises to the interests of all stakeholders and the society. This, in essence, contributes to the Chinese path to modernization of common prosperity for all people.

Enterprises start from G to promote the implementation of ESG, reshape corporate core values, build a sustainable and responsible corporate culture, shape a responsible image that meets the expectations of society, and contribute to the coordinated development of material and cultural-ethical advancement within the enterprise.

Enterprises will carry out ESG concepts and requirements throughout the whole process of going global, adhere to the principle of extensive consultations, joint contribution, and shared benefit with the philosophy of openness, green development and integrity, to co-build high-standard, sustainable, and people-centered Belt and Road, to strengthen the genuine ties between people from all countries, to establish a responsible and green international image of Chinese enterprises, and to achieve the modernization of peaceful development with ESG.

2. ESG promotes the development of responsible investment in central SOEs

In May 2022, The State-owned Assets Supervision and Administration Commission of the State Council (SASAC) issued the Work Plan for Improving the Quality of Listed Companies Held by Central Enterprises, which clearly requires central SOEs to play a leading and exemplary role in the capital market. They should leverage ESG to promote the development of responsible investment in the following three directions:

❏ E-oriented green and low-carbon development is the key investment direction

The company will carry out investment business in accordance with ESG, increasing the awareness on and investing greater capitals in the fields related to the "E" dimension. Using various investment methods such as capital market, fund investment, direct investment and merge and acquisition to screen industries, companies and investment targets that meet ESG standards. This will continuously promote the layout of green and low-carbon industries, accelerate the optimization of industrial structure, and provide vitality and guarantee for sustainable development.

❏ Social investment characterized by S-oriented inclusive development

Investment in the "S" dimension focuses more on serving society and the people, reflecting the characteristics of inclusiveness, amplifying capital leverage, and playing a guiding role of investment. Through investing in key areas such as inclusive finance, inclusive elderly care, industrial poverty alleviation funds to help rural vitalization and urban-rural coordination and integrated development, and strive to ensure the equal access to the rights of development and sharing for all.

❏ A new ESG-oriented investment decision system

At present, increasing numbers of companies have integrated ESG factors into their entire investment process to drive high-quality growth of enterprises. Companies can adopt an investment approach that takes ESG factors into account in portfolio selection and management. For example, ESG factors can be incorporated into a company's investment decision-making system through a "top-down" investment strategy, and ESG factors can be integrated into all aspects and stages of a company's development through its own management operations and the management of investee enterprises. The shift of investment decision system would facilitate high-quality and sustainable development of companies.

3. ESG asset ratio: a new indicator for central SOEs to contribute to Chinese path to modernizaiton

Currently, domestic and international mainstream investment companies are actively participating in the Principles for Responsible Investment (PRI) established by the United Nations. By the end of September 2022, the number of signatories to the UNPRI reached 5,179, with 496 new signatories in 2022, an increase of 10.6% from the end of 2021. In China's mainland, a total of 36 new PRI signatories were added in 2022, which achieved 44.4% growth from the end of 2021, with the growth rate that exceeded the global average. Meanwhile, more and more investors are incorporating ESG information into their investment decisions. According to the Global Sustainable Investment Alliance (GSIA) disclosure, USD 35.3 trillion of sustainable investment account for 36% of the USD 98.4 trillion in total assets under management in 2020. More and more regions around the world are integrating ESG into investment decisions, such as Europe, the United States, Canada, Australia, Japan with ESG assets accounting for 41.6%, 33.2%, 61.8% 37.9% and 24.3%, respectively.

However, a research was conducted by China National Investment Consulting Co., Ltd (CNICC) and GoldenBee Consulting on the current status of ESG management of 91 enterprises of Professional Committee of State-owned Investment Companies, Investment Association of China (IAC), including the President Unit, Vice President Unit, Executive Director Unit, and Director Unit. It found that management of ESG/responsible investment by central SOEs is still in the exploration stage.

Here are the main research findings:

❏ Although nearly 60% of the companies have a certain level of understanding of the basic concept of ESG investment; only 8% (5 companies) take ESG factors into consideration when making investment decisions; a quarter of the companies have plans for ESG/responsible investment, but have not yet carried out substantive actions; the attention of central SOEs to ESG/responsible investment management is much higher than the actual application.

❏ Among the 16 companies that have paid attention to the integration of ESG factors into their investment considerations, it is generally believed that ESG due diligence is an effective entry point for integrating ESG/responsible concepts into the whole life cycle of investment management and is easier to operate. 94% of these companies have a high interest in this work. Post-investment ESG assessment is also a specific management work with a high degree of attention. They pay high attention to the overall understanding of the ESG/responsible investment process, as well as to professional ESG/responsible investment management tools such as ESG investment index systems and databases, all of which exceed 60%.

❏ Of the 5 companies that have incorporated ESG factors into their investment considerations: ESG due diligence is the most frequently used management tool, 3 companies have systematically adopted a holistic approach to ESG investing, 3 companieshave applied an ESG investment indicator system, and only 1 company has used ESG database.

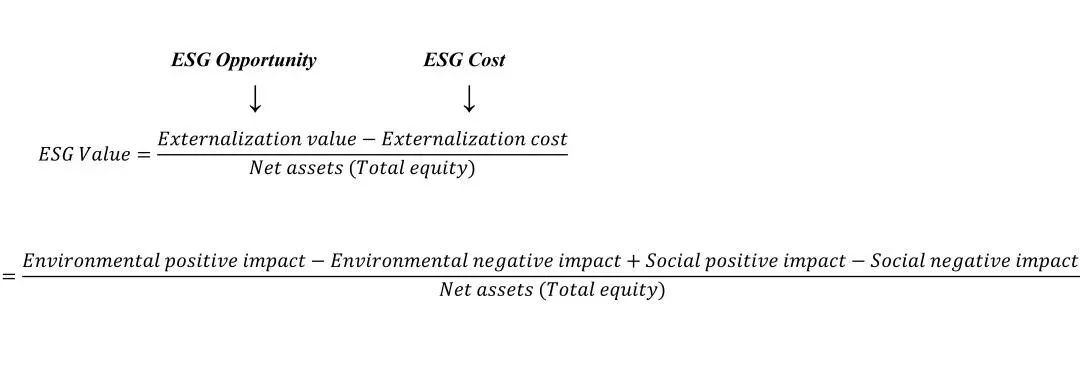

Based on the above research, we suggest that central SOEs can introduce ESG information monetization into ESG investment management to build an evaluation system with "improving ESG asset ratio" as the core, and lead the high-quality development of a sustainable ESG investment paradigm, as shown in the Figure below.

Specifically, we can build a closed-loop investment management by building an ESG index system, forming index measurement standards, collecting ESG data from enterprises through due diligence, selecting projects based on ESG ratings, incorporating ESG factors into investment agreements, and regularly evaluating the ESG performance of enterprises, etc. Ultimately, we can improve the ESG asset ratio to form ESG differentiated competitiveness, continuously increase the proportion of ESG assets in the company's asset portfolio, establish a pioneering image of responsible investment companies, and enhance sustainable development capacities.

After the keynote speech, guests participated in a roundtable discussion on "ESG Management and Practice" and investigated the ESG investment environment in Nanjing.

According to the host, as a strategic city of ESG in Yangtze River Economic Belt, Nanjing continues to practice ESG concept, devotes to build the national ESG pioneer city benchmark, and promotes the new pattern of ESG development in Yangtze River Delta region. In the future, Nanjing will continue to do a good job in all city services from the perspective of entrepreneurs, and transform the ESG business advantages into the quality and effectiveness of serving more projects of foreign investment, central SOEs and large enterprise investment landed in Nanjing.

For more information about ESG management consulting, report, rating, training, etc., you can contact the ESG and Climate Change Services at:

Email: esg@goldenbeechina.com

Tel: 010-62132901

Best Practices

- The 100-year brand — Air Liquide also has a sense of juvenile

- Beijing Public Transportation Corporation: Developing green transportation to build a harmonious and livable capital

- CGN: Building a modern factory in barren deserts and developing a new win-win cooperation model along “Belt and Road”

Upcoming Event

All the materials on the site “Source: XXX (not from this site)” have been reprinted from other media. They do not imply the agreement by the site.

All the materials with “Source: CSR-China Website” are the copyright of CSR-China Website. None of them may be used in any form or by any means without permission from CSR-China Website.

GoldenBee Official WeChat

Copyright © Csr-china.net All Right Reserved.

京ICP备19010813号